North America Industrial Project Spending Up 26.5% in February Year-over-Year

Industrial Info's North American Industrial Project Spending Index shows project spending in February increased 26.5% year-over-year, continuing a positive trend that began in January 2021.

Covering the U.S., Canada and Mexico, the Project Spending Index is a monthly indicator that compares active spending rates with the same month in the previous year to get a measure of growth or contraction in the industrial market. The index provides spending details by industry and market region.

For February, all but three of the 12 industries tracked by Industrial Info posted year-over-year increases in active project spending. The Industrial Manufacturing Industry saw the largest gain, jumping nearly 57.4% and totaling $285.6 billion.

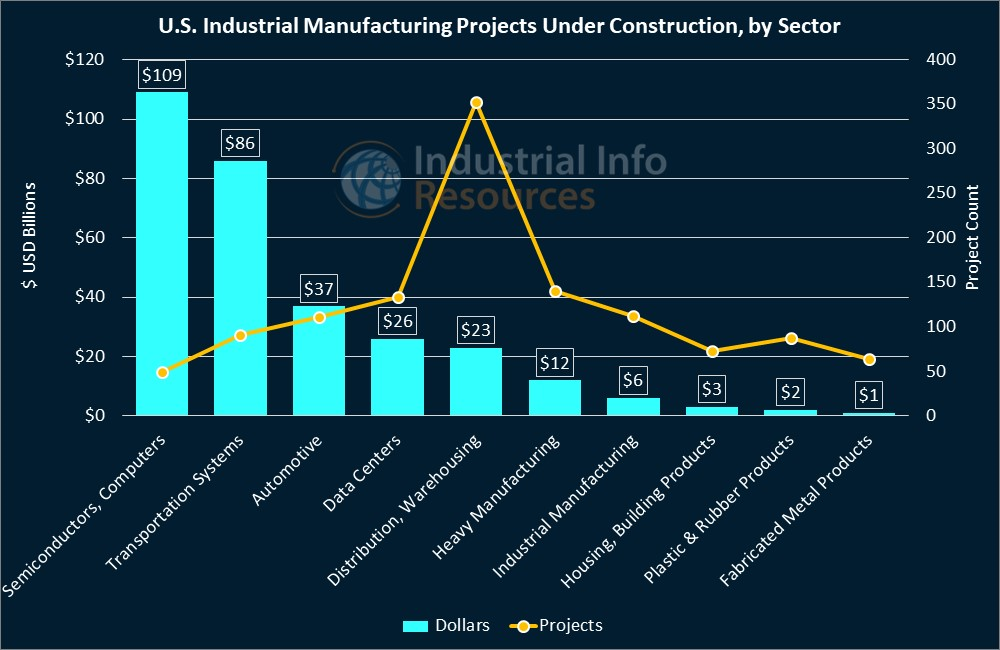

Industrial Info is tracking more than 1,200 active capital Industrial Manufacturing projects in the U.S. that are under construction. Seven of the top projects in terms of spending involve the fabrication of semiconductor chips, as the nation pumps billions of dollars into home-grown chip manufacturing plants. Signed into law on August 9, 2022, the U.S. CHIPS and Science Act provided about $280 billion to boost domestic research and manufacturing of semiconductors.

The largest investment under construction is Intel Corporation's (NASDAQ:INTC) (Santa Clara, California) $30 billion Ocotillo Semiconductor Manufacturing Plant Expansion in Chandler, Arizona. The project involves the construction of two new semiconductor manufacturing plants, totaling 670,000 square feet, bringing the total number of plants at the site to six. Subscribers to Industrial Info's Global Market Intelligence (GMI) Industrial Manufacturing Project Database can click here for the project report.

Prior to the advancement of semiconductor- and computer-related projects in the U.S., the transportation systems sector held the top place in terms of investments. One of those under construction is the California High-Speed Rail Authority's $25 billion High-Speed Rail System CP 1 Segment. As part of a $38 billion project, the CP 1 Segment includes construction of 32 miles of track from Madera County to Fresno County. Subscribers can click here for the project report.

Automotive projects also figure high on the list. In Ellabelle, Georgia, Hyundai Motor Company's (Seoul, South Korea) $5.5 billion grassroot electric vehicle and battery assembly plant is planned for completion in the first quarter of 2025. The plant will produce as many as 300,000 vehicles per year as the automotive industry pivots to all-electric cars and trucks. Subscribers can click here for the project report.

Other industries that posted strong year-over-year gains in February included Oil & Gas Production (rising 51.63% to $147.9 billion) and Food & Beverage (rising 37.5% to $57.7 billion).

Construction Start Values are DownMeanwhile, North American Construction Starts totaled $64.7 billion in February, down 22.3% from February 2022. Seven of the 12 industries tracked by Industrial Info reported drops in spending. According to the latest quarterly survey by the National Association of Manufacturers (NAM), respondents anticipate an increase of 1.8% in capital spending over the next 12 months, lower than 2.3% in fourth-quarter 2022--and the lowest rate since May 2020.

Subscribers can click here for all projects cited in this article and click here for the related plant profiles.