U.S. Gulf Coast Set for Major Offshore Drilling Kickoffs

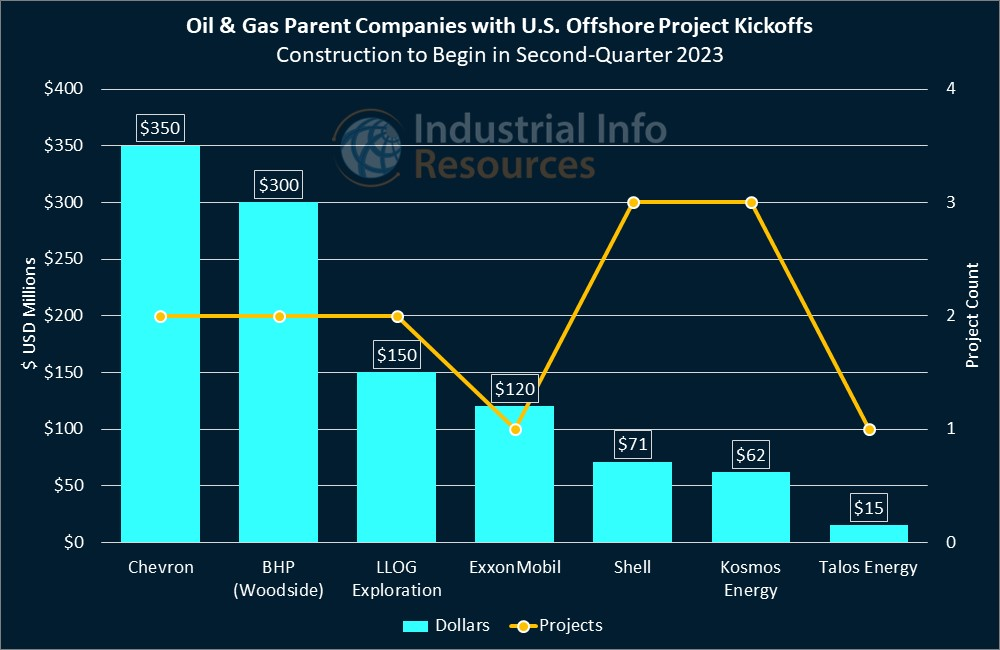

U.S. oil and gas developers are expected to spend $17.5 billion on offshore drilling projects this year, according to Rystad Energy (Oslo, Norway), as exploration companies continue their push for stronger development amid the energy transition. Roughly 15% of U.S. domestic oil production comes from offshore drilling. Industrial Info is tracking more than $1 billion worth of U.S.-based offshore oil and gas development projects that are set to kick off construction in the second quarter.

Chevron leads among exploration companies with about $350 million worth of second-quarter offshore kickoffs, as it prepares to begin activity at its Ballymore Field development in the Gulf of Mexico's Mississippi Canyon Block 607. Following the start of platform construction in the first quarter, Chevron expects to begin installing subsea infrastructure, including templates, wellheads and "Christmas trees," with actual drilling expected to begin in early 2024. First oil is expected in 2025.

The Ballymore discovery is a key factor in Chevron's plans to increase its production in the Gulf to more than 300,000 barrels per day (BBL/d) of oil equivalent by 2026. The company is setting aside more than 20% of its budgeted $11.5 billion in 2023 upstream capital spending for offshore Gulf projects, including a new well in Mississippi Canyon Block 608, just to the east of Ballymore. Subscribers to Industrial Info's Global Market Intelligence (GMI) Oil & Gas Project Database can read detailed reports on Ballymore's platform construction, subsea infrastructure and drilling.

Chevron also is at work on one of the largest decommissioning projects in U.S. waters: the Pacific OCS (Outer Continental Shelf) program off the coast of California, which includes the removal of the Grace Platform in the Santa Clara Field, which was built in 1979. The platform removal is expected to wrap up in the fourth quarter, about one year after Chevron completed the well-plugging and subsea infrastructure removal. Subscribers can learn more from Industrial Info's project report.

BHP Billiton Petroleum, now a subsidiary of Woodside Energy (NYSE:WDS) (Perth, Australia), narrowly trails Chevron with its $300 million worth of second-quarter offshore kickoffs. The spending is related to BHP's Shenzi North Oil Field Development in the Gulf of Mexico's Green Canyon Block 653, where the company is preparing to install subsea infrastructure and begin drilling two wells, from which production capacity is expected to reach roughly 30,000 BBL/d of oil equivalent. Subscribers can read detailed reports on the subsea infrastructure and drilling.

Woodside purchased BHP's oil and gas portfolio in June 2022, further bolstering Woodside's role in the global market for fossil fuels, including the increasingly popular liquefied natural gas (LNG).

"Oil will continue to be an important part of the energy mix for the next 30 years," said Meg O'Neill, the chief executive officer of Woodside, in a recent earnings-related quarterly conference call. "Whilst our foundation is LNG, the BHP Petroleum acquisition really does give us a lot of strengths in the oil side of the house. So we are open to continued investments in all three of these commodities."

LLOG Exploration Company LLC (Covington, Louisiana) is preparing to begin a pair of drilling projects in the Gulf's Keathley Canyon, in the Leon and Castile fields. The company expects to drill two production wells in Leon and another in Castile, following the installation of subsea infrastructure in both areas, which began in first-quarter 2023. First production from both developments is expected by mid-2025. Subscribers can read detailed reports on Leon's drilling and subsea work, and Castile's drilling and subsea work.

Oil produced from Leon and Castile will be collected at LLOG's Salamanca Floating Production Unit (FPU) in Keathley Canyon Block 689, which is being created by the refurbishment of an offshore production facility that had been decommissioned in 2019. Subscribers can learn more from Industrial Info's project report.

"By modifying a previously built production unit, compared with constructing a new facility, we are able to reduce significantly the time and cost to bring these discoveries online," said Philip LeJeune, the chief executive officer of LLOG, of the Salamanca FPU, in a press release announcing the start of its development last year. "We are repurposing an existing unit, which reduces the emissions impact compared to the construction of a new unit by approximately 70%."

Subscribers to Industrial Info's GMI Project Database can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.

Subscribers can click here for a full list of reports for U.S.-based offshore oil and gas development projects that are set to kick off construction in the second quarter.