China Revs Up EV Production, Partnerships as Market Expands

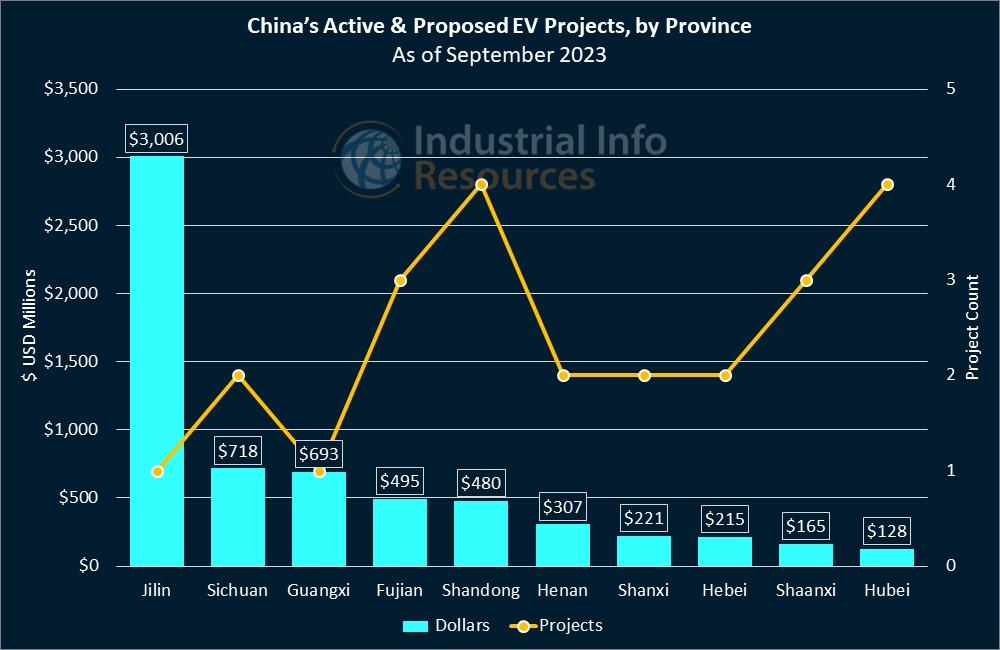

By any measurement, China is the global leader in electric vehicle (EV) production: It accounted for roughly 66% of global EV sales in 2022, and its industry is heavily abetted by generous government subsidies. Although a slumping economy might threaten that financial support, China is still looking at a robust lineup of active and planned projects to develop EVs and their components. Industrial Info is tracking more than US$6.5 billion worth of EV-manufacturing projects--about 60% of which is under construction--and more than US$27 billion worth of EV-battery projects across China.

Among the most recognizable automotive brands to invest heavily in China is Audi, a division of Volkswagen AG (Wolfsburg, Germany), which is partnering with FAW Group Corporation, the nation's oldest and largest vehicle manufacturer, to build the US$3 billion New Energy Vehicles Plant in Changchun, Jilin, which began construction about a year ago and is expected to produce about 150,000 units annually upon completion, in the fourth quarter of 2024. Subscribers to Industrial Info's Global Market Intelligence (GMI) Industrial Manufacturing Project Database can learn more from a detailed project report.

Audi also recently announced a partnership with state-owned SAIC Motor (Shanghai, China) to partner on EV projects in the Chinese market. SAIC began construction this summer on an EV battery plant in Yantai, Shandong, which is expected to produce 160,000 lithium-ion batteries per year. Construction is expected to wrap up in third-quarter 2024. Subscribers can learn more in a detailed project report.

Across China, state-owned companies are expanding their capacity to build EVs, as well as batteries and other components:- In the Guangxi autonomous region, Hechi State-owned Capital Investment & Operation (Group) Company Limited is preparing to begin construction on an EV and parts plant in Hechi, which is expected to produce 500,000 EVs and 1 million units of parts per year. Subscribers can read more in a detailed project report.

- In the Fujian province, Fujian Xinlongma Automobile Company Limited started construction earlier this year on an EV plant in Longyan. Subscribers can read more in a detailed project report.

- In the Henan province, Luoyang Shenlong New Energy Vehicle Company Limited started construction at the beginning of this year on an EV plant in Luoyang. Subscribers can read more in a detailed project report.

China's EV growth has been so rapid that BYD Company Limited (Shenzhen, China), the world's largest electric vehicle manufacturer, recently opened its largest EV charging station in the world in the southeastern city of Shenzhen, as part of a joint venture with Shell plc (NYSE:SHEL). The station, which has 258 charging points and 300,000 kilowatt-hours worth of solar panels, is the latest development from BYD, which aims to make or sell EVs in more than 70 countries on six continents.

BYD's global presence extends to South America, where a subsidiary is preparing to begin construction next year on an electric bus and truck chassis manufacturing plant in Camacari, Brazil. The site, which formerly was owned by Ford Motor Company (NYSE:F) (Dearborn, Michigan), is expected to manufacture up to 150,000 units per year following the addition of several assembly lines later in 2024. Subscribers can read detailed reports on the initial phase and expansion.

China's aggressive push to develop EVs is facing backlash in Europe. Earlier this month, the European Commission began to consider punitive tariffs to protect European Union automakers from relatively inexpensive Chinese EV imports, which it says benefit unfairly from state subsidies. Because the commission's investigation covers all battery-powered cars made in China, brands like Tesla Incorporated (NASDAQ:TSLA) (Austin, Texas) also could be affected, according to Reuters.

It is unclear how such measures would affect European-based EV-manufacturing projects owned by Chinese companies. A subsidiary of BYD is seeking permits to build an EV plant in Szombathely, Hungary, which could begin construction as early as next year. BYD began to deliver its electric vans and trucks to the Hungarian market last year. Subscribers can read more in a detailed project report.

Chinese state subsidies for electric and hybrid vehicles totaled US$57 billion from 2016 through 2022, according to consulting firm AlixPartners.

Subscribers to Industrial Info's GMI Project Database can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.

Subscribers can click here for a full list of reports for active and planned EV-manufacturing projects across China, and click here for a full list of reports for EV battery projects.