Permian Primed to Lead U.S. Gas Production, Processing Boom

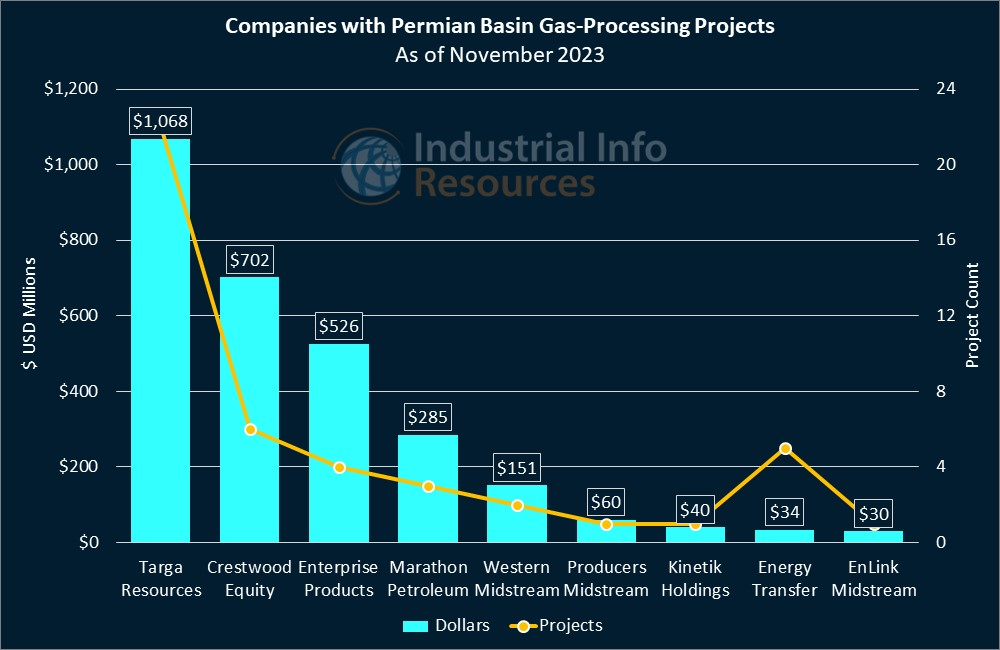

Natural gas production in the "Lower 48" U.S. states is expected to grow 5% in 2023 and 2% in 2024, adding 5 billion and 1.8 billion cubic feet per day, respectively, according to the U.S. Energy Information Administration's (EIA) Short-Term Energy Outlook. Most of the forecast growth comes from the Permian region, which currently accounts for about 5% of all marketed natural gas production in the Lower 48. The boom in production has gas-processing companies in the area scrambling to expand capacity. Industrial Info is tracking nearly $3 billion worth of active and planned gas-processing projects across the Permian Basin, about 80% of which is attributed to just three companies: Targa Resources Corporation (NYSE:TRGP) (Houston, Texas), Crestwood Equity Partners LP (NYSE:CEQP) (Houston) and Enterprise Products Partners LP (NYSE:EPD) (Houston).

The EIA expects natural gas production in the Permian alone will increase by 11% in 2023 and 6% in 2024, adding 2.2 billion and 1.4 billion cubic feet per day, respectively. The EIA notes most gas production in the Permian occurs in crude oil reservoirs: "As a result, producers in the Permian region typically respond to changes in the crude oil price when planning their exploration and production activities," it noted in a recent posting, which is why higher crude oil prices likely will help to spur more natural gas production.

Targa, which accounts for more than $1 billion of the total investment, is more than doubling the processing capacity at its Wildcat Natural Gas Processing Plant in Wink, Texas, which is in the heart of the Permian Basin and near the southeastern corner of New Mexico. Company executives have acknowledged Targa is "playing catch up" in the Permian's Delaware Basin, where heavy natural gas production has largely exceeded all predictions. The $200 million Train II addition would bring Wildcat's total capacity to 500 million standard cubic feet per day.

On the other side of the state line, but within the Delaware Basin, Targa is preparing to begin construction in 2024 on a $150 million Train II addition at its Roadrunner Natural Gas Processing Plant in Loving, New Mexico, which could double Roadrunner's capacity to more than 450 million standard cubic feet per day. The company is considering another expansion upon its completion: the $200 million Train III, which could triple capacity to as much as 690 million standard cubic feet per day. Subscribers to Industrial Info's Global Market Intelligence (GMI) Oil & Gas Project Database can read detailed project reports on Wildcat II, Roadrunner II and Roadrunner III.

"Our Wildcat II and Roadrunner II plants remain on track to begin operations in the first and second quarters of 2024, respectively, and both plants are expected to start up highly utilized given the robust activity across our entire Delaware footprint," said Matt Maloy, the chief executive officer of Targa, in a recent earnings-related conference call. "We are currently offloading an average of around 70 million cubic feet per day of gas in the Permian and are in the process of adding significant compression horsepower during the balance of the year, and are continuing to see strong producer activity across our acreage."

Targa also is at work on the Daytona NGL Pipeline, an addition to the Grand Prix natural gas liquids (NGL) pipeline, in which Targa acquired full ownership earlier this year. Daytona is designed to transport up to 550,000 barrels per day (BBL/d) of NGL from the Permian Basin to the Grand Prix pipeline in northern Texas, which then carries it to the company's fractionation and storage complex in Mont Belvieu. Targa is proposing a new pump station in Midland, Texas, which would support the Daytona expansion. Subscribers can learn more from a detailed project report, and from Industrial Info's January 4, 2023, article - Targa Resources Buys Full Stake in Grand Prix NGL Pipeline.

Crestwood, which purchased Sendero Midstream Partners LP from Energy Capital Partners (Summit, New Jersey), is considering the proposed trains III and IV at the Carlsbad Gas-Processing Complex in Loving. Together, the new trains could raise Carlsbad's processing capacity from 350 million to as much as 770 million standard cubic feet per day. Subscribers can read detailed reports on Train III and Train IV.

Not to be outdone, Enterprise is preparing to triple capacity at its gas-processing complex near Mentone, Texas, to 900 million standard cubic feet per day of natural gas and 90,000 BBL/d of NGL, through the additions of the $150 million Train II and $150 million Train III. Construction on Train II began in third-quarter 2022 and is set to wrap up in the coming weeks; construction on Train III began over the summer and is expected to be completed by the end of first-quarter 2024. Subscribers can read detailed reports on Train II and Train III.

Subscribers to Industrial Info's GMI Project Database can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.Subscribers can click here for a full list of reports for active and planned gas-processing projects across the Permian Basin.