U.S. Gas-Fired Power Generators Bolster Plants as Demand Rises

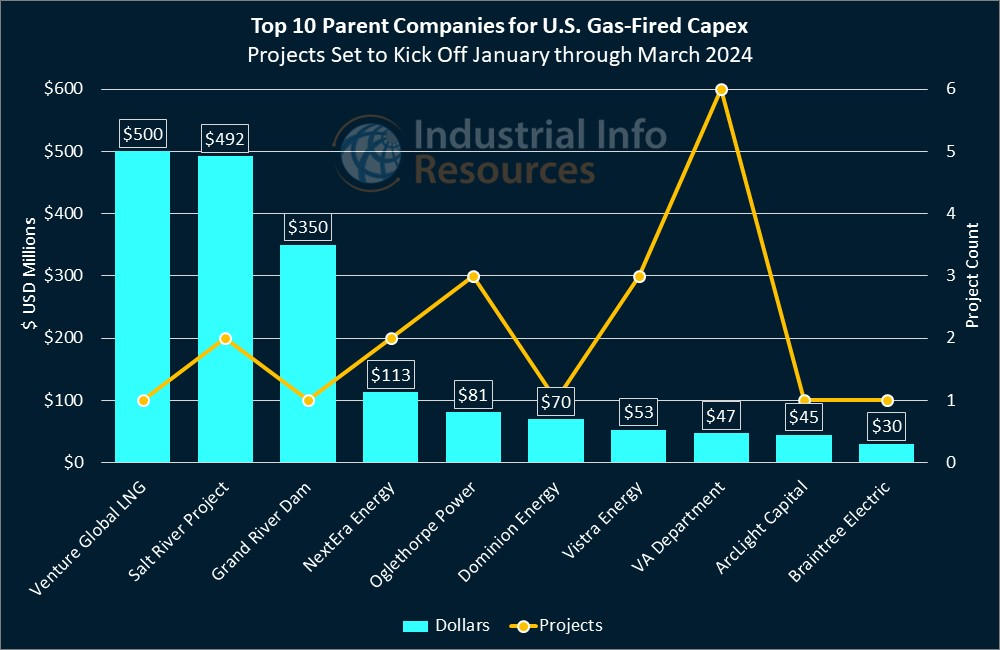

U.S. natural gas demand is expected to hit record highs for full-year 2023, according to the U.S. Energy Information Administration (EIA), and likely will continue next year, before leveling off after mid-decade. Gas-fired power generation producers are responding with expansions and upgrades at their busiest facilities. Industrial Info is tracking about $1.9 billion worth of capital-spending projects at U.S. gas-fired plants that are set to begin construction in the first quarter of 2024, more than $1.4 billion of which is attributed to projects that Industrial Info's researchers believe have a medium-to-high likelihood (70% or more) of moving forward as planned.

From 2024 through 2025, the EIA estimates 7.7 gigawatts (GW) of U.S. gas-fired power generation capacity will begin service, following 8.6 GW estimated to be brought online in 2023 alone. For more information, see October 19, 2023, article - U.S. to Add More than 16 GW of Gas-Fired Capacity through 2025.

The highest-valued project designed to add gas-fired power generation that is set to kick off next quarter comes from the State of Oklahoma, where its largest public utility, the Grand River Dam Authority, is preparing to add the $350 million Block 4 at the Grand River Energy Center in Chouteau, about 40 miles east of Tulsa. Developers of the 495-megawatt (MW), gas-fired, combined-cycle (NGCC) unit are keeping an eye on the future: Block 4 will replace the center's Unit 2, a 492-MW, coal-fired generator, and in coming years will be able to operate entirely or on a blend of hydrogen.

In October, Grand River Dam Authority signed an agreement with Mitsubishi Power (Yokohama, Japan) for the latter to provide an advanced-class gas turbine to the Grand River Energy Center, which the developers say points to a market shift favoring advanced-class gas turbines for peaking applications. Mitsubishi Power developed its first J-series, advanced gas turbine in the U.S. for the Grand River Energy Center's 500-MW Unit 3, which began operations in 2017. Subscribers to Industrial Info's Global Market Intelligence (GMI) Power Project and Plant databases can learn more from a detailed project report and plant profile.

Other proposed NGCC additions include a major project on the Gulf Coast: Venture Global LNG's (Arlington, Virginia) 720-MW power plant at its Calcasieu CP2 LNG Terminal in Cameron, Louisiana, which will feature an additional 25-MW gas-fired aeroderivative turbine. Venture Global plans to use the NGCC plant to power its liquefied natural gas (LNG) export facility, a two-phase project designed to eventually produce nearly 20 million metric tons per year of LNG. Subscribers can read more in a detailed plant profile and project reports on the NGCC plant and LNG Phase I and Phase II.

The Gulf Coast region is set to see its natural gas-fired generation capacity increase in years to come, following a decision by Texas voters to approve $7.2 billion in loans and grants for gas-fired power plants. For more information, see November 10, 2023, article - Texans Approve Billions in Funding for Natural Gas Power Generation.

Southeast Energy Group, a subsidiary of Dominion Energy Incorporated (NYSE:D) (Richmond, Virginia), is planning to upgrade some of its existing gas-fired power capacity with a $70 million repowering of its Parr Power Station in Jenkinsville, South Carolina, which will increase the facility's output from 72 to 114 MW. Southeast Energy plans to replace four combustion turbines with a pair of aeroderivative models from General Electric (NYSE:GE) (Boston, Massachusetts), which are cleaner and less costly than traditional models. The repowering is expected to wrap up toward the end of 2024. Subscribers can learn more from a detailed project report.

A smaller amount of investment is going toward environmental, social and governance (ESG) projects, which are aligned with the growing calls for a reduced dependence on fossil fuels. A subsidiary of Baxter International Incorporated (NYSE:BAX) (Deerfield, Illinois) is preparing to begin construction on an additional power unit at its inhalation anesthetics plant in Guayama, Puerto Rico, which would generate 2 MW from gas turbines and 2 MW from combined heat and power (CHP), which is estimated to produce about half the annual carbon dioxide (CO2) emissions when compared with a conventional boiler. Excess energy from the plant will go toward Puerto Rico's power grid. Subscribers can learn more from a detailed project report.

Subscribers to Industrial Info's GMI Project Database can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.

Subscribers can click here for a full list of reports for U.S. gas-fired projects that are set to begin construction in the first quarter of 2024.