U.S. Home to $72 Billion in Planned 1Q ESG-Related Project Kickoffs

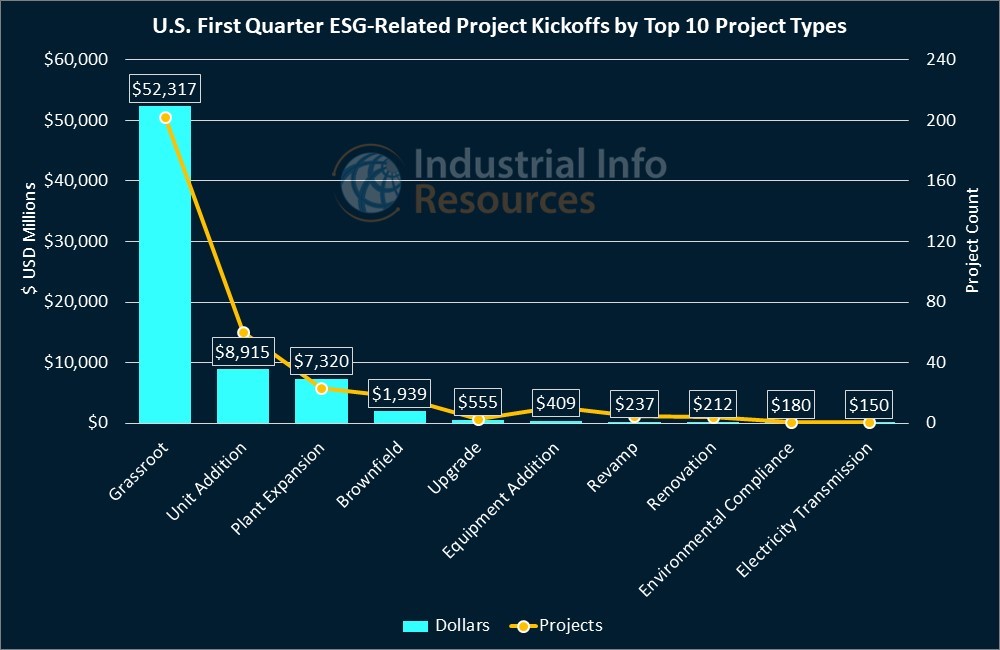

Projects in support of environmental, social and governance (ESG) initiatives continue to pop up across the U.S. as a host of industries continue to decarbonize their operations and add renewable sources of energy. Industrial Info is tracking $72 billion worth of ESG-related projects in the U.S. that are planned to kick off in the first quarter, with more than half of the spend attributed to projects that have a medium-to-high (70% or higher) likelihood of beginning construction as currently scheduled. About one-fourth of the total spend is attributed to grassroot projects, buoyed by the development of solar and wind generation.

Solar-generation project activity includes construction of Renegade Renewables LLC's planned $900 million Dawn photovoltaic solar farm near Hereford, Texas, about 50 miles southwest of Amarillo. The facility will include more than 1.5 million solar panels on a single-axis, ground-mounted tracking system to achieve a nameplate generating capacity of more than 650 megawatts (MW). Major engineering, procurement and construction firm M.A. Mortenson (Minneapolis, Minnesota) expects to kick off construction in January, with completion in early 2026. Renegade Renewables is a unit of Blue Planet Funding (New York. New York). The solar farm will connect to the ERCOT North Hub, which includes Dallas. Subscribers to Industrial Info's Global Market Intelligence (GMI) Power Project Database can click here for the full project report.

While solar projects dominate first-quarter ESG kickoffs, the U.S. is not without wind project activity--and one of the largest onshore wind projects being tracked by Industrial Info is set to kick off in January. The Sunzia project in New Mexico's Lincoln and Guadalupe counties being constructed for Pattern Energy Group (San Francisco, California) will include approximately 900 turbines, each rated above 3 MW, to provide nameplate generation of 3,000 MW. The project is expected to be completed in 2026 and its output is designed to be carried via a related transmission line, to be deployed in the Western U.S. Subscribers can click here for more details, and read May 17, 2023, article - Pattern Energy Signs PPAs for Major SunZia Wind Project.

Aside from renewable energy development, another ESG trend is the abatement and storage of carbon dioxide (CO2) emissions.

One example is Exxon Mobil Corporation's (NYSE:XOM) (Spring, Texas) equipment additions at its Shute Creek Natural Gas Treatment Complex near Kemmerer, Wyoming, in the LaBarge Field, which will support the first phase of a carbon-capture effort that features three components. The installation of new equipment, which is planned to begin in February, includes adding a new high-pressure CO2 product compressor, and other equipment, to capture 50 million cubic feet per day of CO2. Construction of the other two components is expected to kick off in April: nine miles of 10-inch-diameter pipeline will carry the captured CO2 to a planned disposal well that sits on federal land owned by the Bureau of Land Management. Subscribers to the Oil & Gas Pipelines and Production project databases can read detailed reports on the equipment addition, pipeline and disposal well projects.

The project will allow the Shute Creek facility, which already captures between 6 million and 7 million metric tons of CO2 per year, to capture up to an additional 1.2 million metric tons per year. Operations could begin as early as 2025, according to ExxonMobil.

The Industrial Manufacturing ($7.2 billion) and Pharmaceutical & Biotech ($4.6 billion) industries trail Power in terms of the total investment value of first quarter ESG-related construction starts, although plant expansions account for about half of the spend.

To no surprise, activity in the Industrial Manufacturing Industry is buoyed by projects related to electric vehicles (EVs). With a medium (70-80%) chance of moving forward as planned, Tesla Incorporated (NASDAQ:TSLA) (Austin, Texas) expects to begin a $3.6 billion expansion of its 5.4 million-square-foot gigafactory in Sparks, Nevada, which it jointly operates with Panasonic Holdings Corporation (Osaka, Japan). The project entails constructing two new buildings totaling approximately 4 million square feet--a high-volume semi-truck production building and a lithium ion-battery cell production building with an annual capacity of 100 gigawatt-hours--which will allow for the production of batteries for 1.5 million light-duty vehicles per year. Subscribers to the Industrial Manufacturing Project Database can click here for a project report.

Meanwhile, Yale University (New Haven, Connecticut) plans to begin construction on a $350 million expansion of a research center, which entails adding a 253,000-square-foot research laboratory building, a chemistry safety facility and other buildings, all of which are designed to reach net-zero emissions. The university has an interim goal of reaching net-zero emissions by 2035. Subscribers to the Pharmaceutical & Biotech Project Database can click here to read a detailed project report.

For information on ESG trends in the Pharmaceutical & Biotech, Petroleum Refining, and Metals & Minerals industries, see November 16, 2023, article - IIR Webinar: Pharma-Biotech Sector Strives to Keep up With Trends, Maximize Profits, July 13, 2023, article - Petroleum Refining: How ESG Projects are Driving Energy Transition, and July 20, 2023, article - IIR Webinar: Geopolitics, Resource Nationalism, ESG Initiatives Affect Mining Spending.

Subscribers to the GMI Database can click here for all project reports mentioned in this article and here for related plant profiles.