Oil & Gas Producers See Record Results Across Alberta

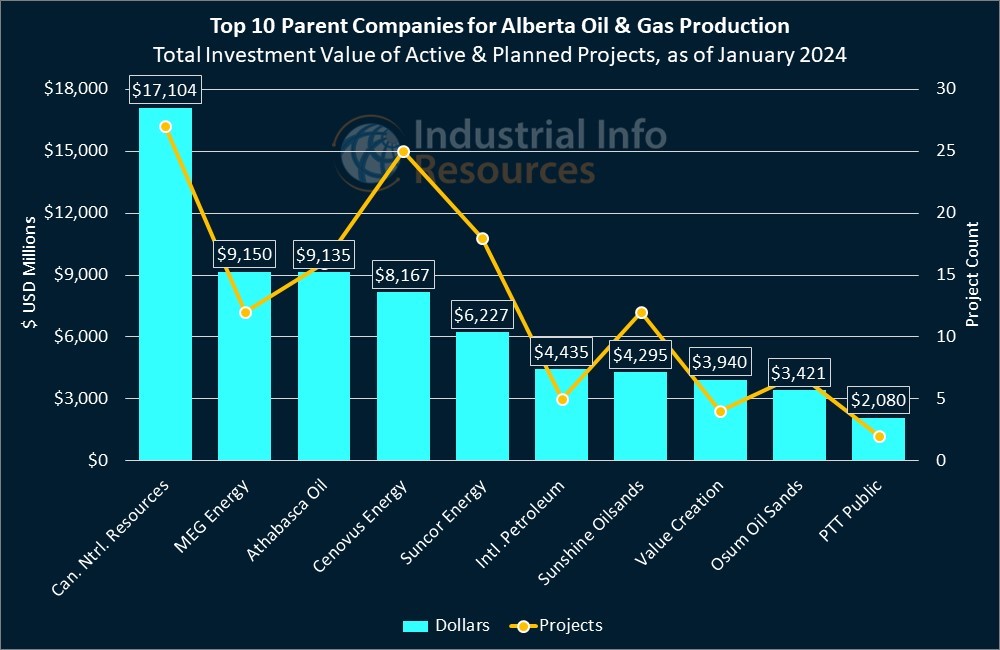

Researched by Industrial Info Resources (Sugar Land, Texas)--Canadian Natural Resources Limited (NYSE:CNQ) (Calgary, Alberta) (CNRL) is among the major Canadian oil and gas producers to report impressive production totals from Alberta for the end of 2023, as the "Texas of Canada" proved more bountiful than expected for the fossil fuel market. CNRL joined heavy-hitters like Suncor Energy Incorporated (NYSE:SU) (Calgary) and Cenovus Energy Incorporated (NYSE:CVE) (Calgary) in reporting record results--and expressing discomfort on a cap-and-trade plan proposed by federal regulators. Industrial Info is tracking more than US$77 billion worth of active and planned Oil & Gas Production projects in Alberta, including more than US$10.2 billion worth with a 70% or higher likelihood of kicking off before the end of 2024.

CNRL's oil and gas production from Alberta totaled 703,330 barrels of oil equivalent per day (BOE/d), its highest since 2018, with its gas production hitting a record 1.593 billion cubic feet per day. The company is preparing to begin an expansion and replacement project at its Wolf Lake bitumen-processing plant and gathering field near Bonnyville, Alberta, which currently has a 140,000-barrel-per-day (BBL/d) capacity. In addition to replacing aged components, CNRL aims to improve the facility's gathering system by constructing between 40 and 50 miles of steel pipe to carry fuel gas, diluted bitumen and steam to and from the production well pads.

CNRL also is seeking permits to expand its Smith and Pelican Lake developments near Slave Lake, Alberta, for which it aims to drill between 170 and 190 new wells and build gathering field tie-ins to boost its production of heavy crude oil from the Smith and Pelican Lake fields. Subscribers to Industrial Info's Oil & Gas Production Project Database can read detailed reports on the Wolf Lake and Smith/Pelican Lake projects.

Meanwhile, Suncor said its upstream crude production totaled 808,000 BBL/d for the fourth quarter, the second-highest quarterly total in its history, including an all-time record of 900,000 BBL/d for December. Much of this growth was driven by its Fort Hills and Syncrude facilities in Alberta, which totaled 534,000 BBL/d. In December, Suncor executives said they expect 2024's upstream production to total between 770,000 and 810,000 BBL/d, about 7% higher than its final estimate for 2023 production; the growth is attributed, in part, to what will be its first year of full ownership of Fort Hills.

Just southeast of the Fort Hills project, Suncor hopes to perform a debottlenecking of its Firebag Bitumen-Processing Plant, which produces up to 215,000 BBL/d. The company expects debottlenecking the facility's inlet and separation sections will reduce back pressure and add 20,000 BBL/d of bitumen production. Subscribers can learn more from a detailed project report.

But Canada's Oil & Gas Industry is wrestling with a new challenge: At last month's COP28 climate summit in Dubai, Canada's federal government announced a draft framework for a cap-and-trade system, which would require related companies to cut emissions by 35% to 38% from 2019 levels--unless they buy offset credits--starting in 2030. Officials in Alberta joined industry leaders in harshly criticizing the proposed legislation, under which federal officials would gradually reduce allowances until Canada reaches net-zero in 2050.

Detailed regulations are expected to arrive this spring, with supporters hoping to finalize the regulations in early 2025. Natural Resources Minister Jonathan Wilkinson later told reporters after the announcement that the cap "is structured in such a way that we are focused on what is technically feasible" without cutting production. But industry leaders across Alberta and other major oil-producing areas in Canada do not believe the goals can be achieved without cutting production.

To reduce greenhouse gas emissions, producers in Alberta are considering up to US$1.4 billion worth of cogeneration-technology projects, which capture the heat generated from the facility's on-site power generation, thus reducing the need for grid-based generation, transmission and distribution. Cenovus is considering natural gas-fired cogeneration unit additions at its Meadow Creek and Narrows Lake complexes, both near Fort McMurray. Each would supply their facilities with 85 megawatts (MW). Subscribers can read detailed reports on the Meadow Creek and Narrows Lake projects.

When excluding oil sands activity, Cenovus' December production in Alberta trailed only CNRL, exceeding 635,000 BBL/d.

Subscribers to Industrial Info's GMI Project Database can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.

Subscribers can click here for a full list of reports for active and planned Oil & Gas Production projects in Alberta.