U.S. Transmission Sector Readies for $10 Billion in Second-Quarter Starts

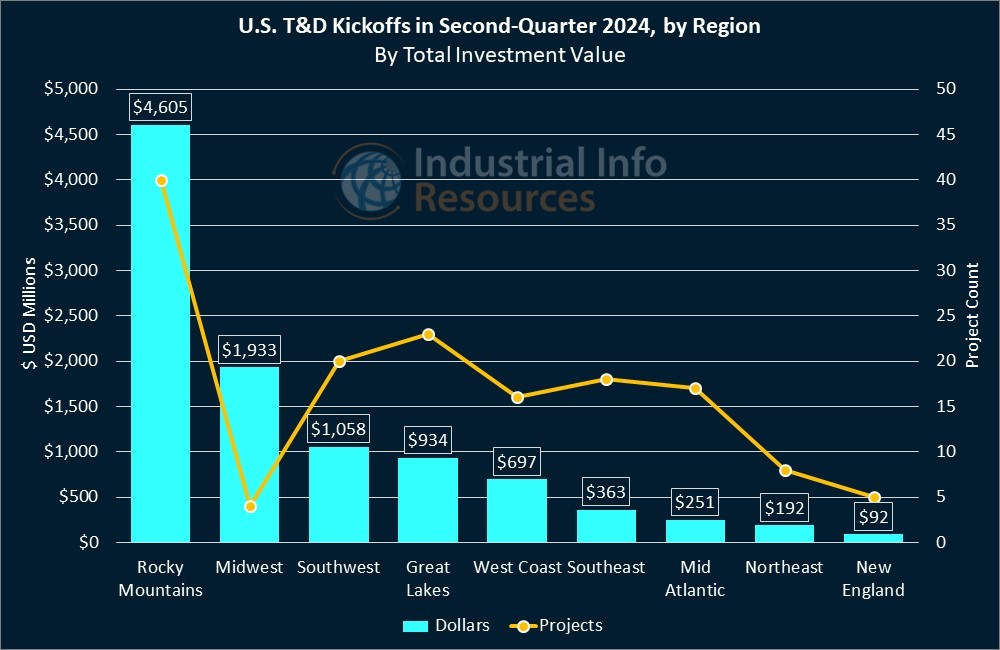

The U.S. transmission and distribution (T&D) sector is facing calls for rapid and wide-ranging expansions, as various power markets race to reach underserved areas, improve efficiency, incorporate more renewable generation, and connect with offshore resources. Industrial Info is tracking more than $10 billion in U.S.-based T&D projects that are set to kick off in the second quarter of 2024, nearly half of which is attributed to projects in the Rocky Mountains region.

T&D developers traditionally have faced a swath of geographic challenges in the Rocky Mountain region, such as difficult terrain for line construction, outdated infrastructure, and low-density areas starved for better energy access. In a sparsely populated area of southern Colorado, Xcel Energy Incorporated (NASDAQ:XEL) (Minneapolis, Minnesota) is preparing to spend $30 million to upgrade lines from Alamosa to Romeo, which total about 20 miles, and $15 million to upgrade lines from Romeo to Antonito, which total about eight miles. The aging lines will have their capacity raised from 69 to 115 kilovolts (kV).

Subscribers to Industrial Info's Global Market Intelligence (GMI) Power Project Database can read detailed reports on the Alamosa-to-Romeo and Romeo-to-Antonito projects.

Other T&D projects in the Rocky Mountains region are intended to help power-generation developers take advantage of the region's generous renewable resources. ibV Energy Partners LLC (Miami, Florida) is preparing to build $25 million worth of transmission lines near Boulder City, Nevada, which is about 25 miles southwest of Las Vegas, to connect ibV's upcoming Boulder Flats Solar Facility to the power grid. Boulder Flats is expected to generate 113 megawatts (MW) and feature a 60-MW battery energy-storage system. Subscribers can read detailed project reports on the transmission lines and solar plant.

Large-scale power-consuming projects across the U.S. are driving calls for higher-capacity, more efficient T&D systems. Arizona Public Service Company, a subsidiary of Pinnacle West Capital Corporation (NYSE:PNW) (Phoenix, Arizona), is developing the $30 million Runway Power Line in Goodyear, Arizona, just west of Phoenix, to connect the $18 million Diamond Substation, also set to begin construction, and the Runway Substation, which is preparing for a $12.5 million upgrade.

The Runway Substation serves Microsoft Corporation's (NASDAQ:MSFT) (Redmond, Washington) Goodyear Data Center, while the Diamond Substation is being designed to serve STACK Infrastructure's (Denver, Colorado) planned data center campus in Avondale. Data centers typically consume heavy amounts of energy, and buildouts from these companies and their peers often have T&D developers struggling to keep up with demand. Subscribers can read detailed reports on the Runway Power Line, Diamond Substation and Runway Substation upgrades.

Many developers are turning to underground transmission lines, as they are less affected by extreme weather and more reliable than overhead lines. SOO Green Energy, an Iowa-based partnership among numerous companies, is developing the $1.29 billion SOO Green HVDC Link Project from Mason City, Iowa, to Plano, Illinois. The 350-mile, underground, high-voltage direct current (HVDC) line will connect the two largest U.S. power markets--MISO and PJM--along an existing railroad line. It will be supported by new, $600 million converter stations in Mason City and Plano. Direct Connect Development Company LLC (Minneapolis, Minnesota) is managing the project, which is set to wrap up in the third quarter of 2025.

The SOO Green partnership selected Prysmian Group (Milan, Italy) to supply HVDC cable systems for the project, which backers say will better deliver low-cost renewable energy to consumers in the region. Subscribers can read detailed reports on the SOO Green line and the related converter stations in Mason City and Plano.

Other T&D projects are catering specifically to high-profile power-generation projects, such as Equinor's (NYSE:EQNR) (Stavanger, Norway) much-anticipated Empire Windfarm off the New York coast. The Empire project has cleared major hurdles in recent months as other U.S.-based offshore-wind projects have struggled, and it is expected to generate about 816 MW upon completion of its $850 million first phase. It is to be supported by a $70 million offshore substation, which will send the power produced at the facility 35 miles via a $60 million submarine line to the existing Gowanus Substation in Sunset Park.

Subscribers can read detailed project reports on the Empire Windfarm, its substation and its transmission line. For more information on some of the most recent developments in the U.S. offshore wind market, see February 26, 2024, article - U.S. Offshore Wind Sector Sees New Generation, Sale and Construction Approval.

Subscribers to Industrial Info's GMI Project and Plant databases can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.

Subscribers can click here for a full list of reports for active and planned T&D projects across the U.S. that are set to begin construction in the second quarter.