DAC Rivals Carbon Capture Among ‘Greening’ U.S. Companies

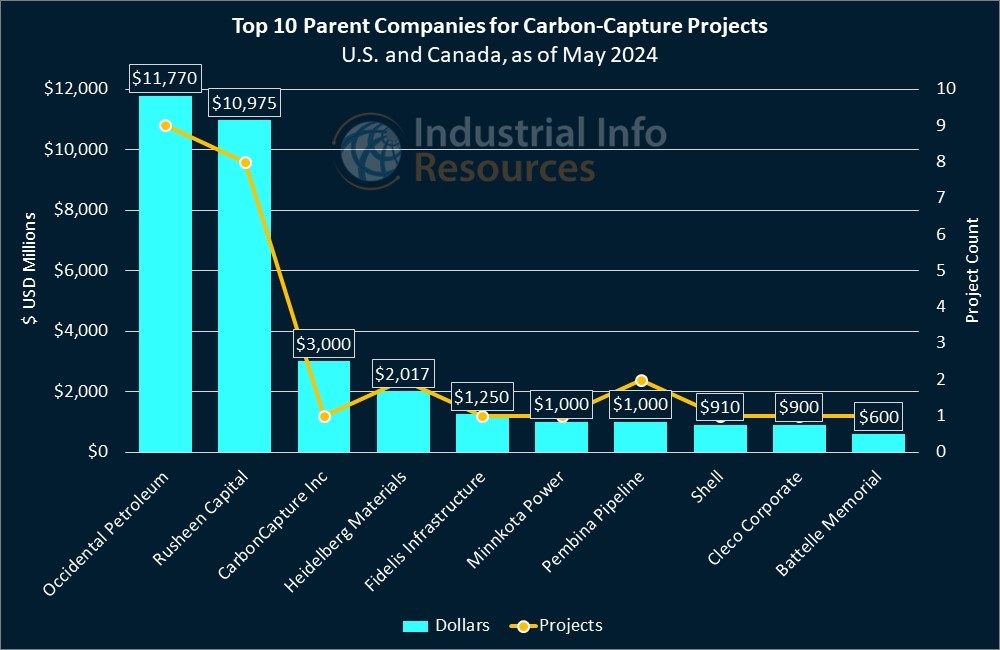

The direct air capture (DAC) of carbon dioxide (CO2) is becoming one of the most crowded lanes in the race for greener energy, with companies ranging from Exxon Mobil Corporation (NYSE:XOM) (Spring, Texas) to Facebook parent Meta Platforms Incorporated (NASDAQ:META) (Menlo Park, California) offering their own approaches to the technology. That's not to say the more commonplace carbon-capture method is receding, though. Industrial Info is tracking more than $40 billion worth of DAC and carbon-capture projects across the U.S. and Canada.

The International Energy Agency (IEA) defines DAC as technology that extracts CO2 "directly from the atmosphere at any location, unlike carbon capture, which is generally carried out at the point of emissions." The CO2 can be permanently stored in deep geological formations or used for a variety of applications, according to the IEA.

Occidental Petroleum Corporation (NYSE:OXY) (Houston, Texas) leads among North American companies in the DAC field, with a series of ambitious projects focused on Texas. 1PointFive, a joint venture formed with BlackRock (NYSE:BLK) (New York, New York), is preparing to begin construction this summer on the $600 million first phase of the South Texas DAC hub on the King Ranch in Kleberg County, Texas.

The first phase of the King Ranch project is designed to capture 1 million tons of CO2 each year, but the joint venture believes a series of subsequent phases could result in up to 30 million metric tons of carbon removed and stored per year. Subscribers to Industrial Info's Global Market Intelligence (GMI) Oil & Gas Production Project and Plant databases can learn more from a detailed project report and plant profile.

"We're excited also about our joint venture with BlackRock, which we believe demonstrates the DAC is becoming an investable asset for world-class financial institutions," said Vicki Hollub, the chief executive officer of Occidental, in a recent quarterly earnings-related conference call. "In addition, our team signed on several more flagship CO2 removal credit customers" in the fourth quarter of 2023, she added.

In conjunction with Rusheen Capital Management LLC (Santa Monica, California), a private equity firm focused on low-carbon technology, 1PointFive is developing the $125 million first unit of the Stratos Shoe Bar Ranch DAC Complex near Penwell, Texas, which is designed to capture 500,000 metric tons per year of CO2, which would be repurposed in Occidental's enhanced oil recovery (EOR) efforts in the Permian Basin; a $100 million second unit, concurrently under construction, would double the CO2 captured. Subscribers can learn more through detailed reports on Unit 1 and Unit 2, a detailed plant profile, and Industrial Info's November 10, 2023, article - Occidental Has High Hopes for Direct Air Capture of Carbon Emissions.

Among the oil and gas titans upping their investments in carbon-capture technology is ExxonMobil, which is preparing to begin construction on $200 million in equipment additions at its Shute Creek Natural Gas Treatment Complex near Kemmerer, Wyoming, which would allow the complex to capture roughly 600,000 metric tons of CO2 each year, which will be sent to ExxonMobil's CO2 sales facility in Sweetwater County, Wyoming. Subscribers can learn more from a detailed project report and plant profile.

In a recent earnings call, ExxonMobil's Chief Executive Officer Darren Woods stressed the company was in the early phases of its carbon-capture development: "There's a question of how we can better capture CO2 by using advances in the existing technology. We think we've come up with an opportunity to potentially do that, but it's early days like all these technological developments. And so, we built a pilot plant, and we'll see and test out some of these new capabilities and test the cost effectiveness of capture." For more information on ExxonMobil's carbon-capture pilot plant in Rotterdam, The Netherlands, see Industrial Info's project report.

Many players in the Metals & Minerals Industry are following their counterparts in the Oil & Gas Industry by adopting DAC and carbon-capture technology, particularly in the steel-manufacturing sector, which is among the heaviest CO2 emitters. United States Steel Corporation (U.S. Steel) (NYSE:X) (Pittsburgh, Pennsylvania) aims to capture and mineralize up to 50,000 metric tons per year of CO2 through a $150 million carbon-capture unit addition and a $3.46 million DAC and utilization unit addition at its Steel Works complex in Gary, Indiana, both of which are set to begin construction this summer. Subscribers can learn more from detailed project reports on the carbon-capture unit and DAC unit, and a detailed plant profile.

Subscribers to Industrial Info's GMI Project and Plant databases can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.

Subscribers can click here for a full list of reports for active and planned U.S. and Canadian carbon-capture projects.

In addition to projects dedicated to the capture and recovery of CO2, Industrial Info is tracking more than $3 billion worth of projects across the U.S. and Canada that are dedicated to the storage and sequestration of CO2. Many of these projects are being planned in conjunction with carbon-capture projects, such as those mentioned above. Subscribers can click here for a list of detailed project reports and click here for a list of related plant profiles.