EPA's Ethanol Decision Could be Profitable for Corn-Heavy States

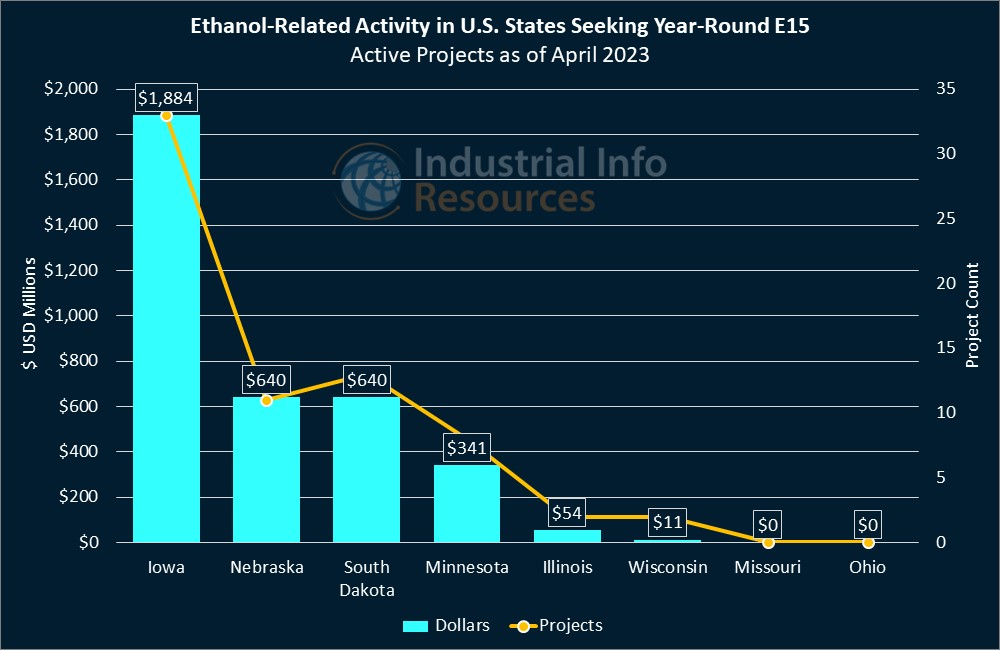

The Biden administration is renewing efforts to allow year-round sales of higher-ethanol fuel in eight states across the central U.S., all of which feature corn as a significant ingredient in their agricultural economies. The governors of Illinois, Iowa, Minnesota, Missouri, Nebraska, Ohio, South Dakota and Wisconsin have been pushing the U.S. Environmental Protection Agency (EPA) to lift a long-standing ban on summertime sales of E15 gasoline, which is 15% ethanol. Industrial Info is tracking about more than $3.3 billion worth of active ethanol-related projects across these eight states.

The EPA's proposal, which is widely viewed as a means to reduce gasoline prices (albeit marginally) and bolster the economies of "breadbasket" states, likely would take effect in the summer of 2024. Historically, the agency has banned summer sales of E15 because it once was believed to be a bigger contributor to smog than E10 (which contains 10% ethanol) and other alternative fuels.

Years of research, however, have proven E15's smog-creating capability to be no worse than that of E10. (Normally, the EPA maintains seasonal restrictions on the evaporation potential of gasoline, which contributes to emissions. Some U.S. states, such as California, have even tighter standards.)

"[The] EPA's research has shown no significant impact on evaporative emissions when the 1.0-psi waiver [normally for fuels with 10% ethanol] is extended to E15," the agency said in May 2022, after the change was initially proposed. "With no significant impacts on emissions from cars and trucks, we expect consumers can continue to use E15 without concern that its use in the summer will impact air quality."

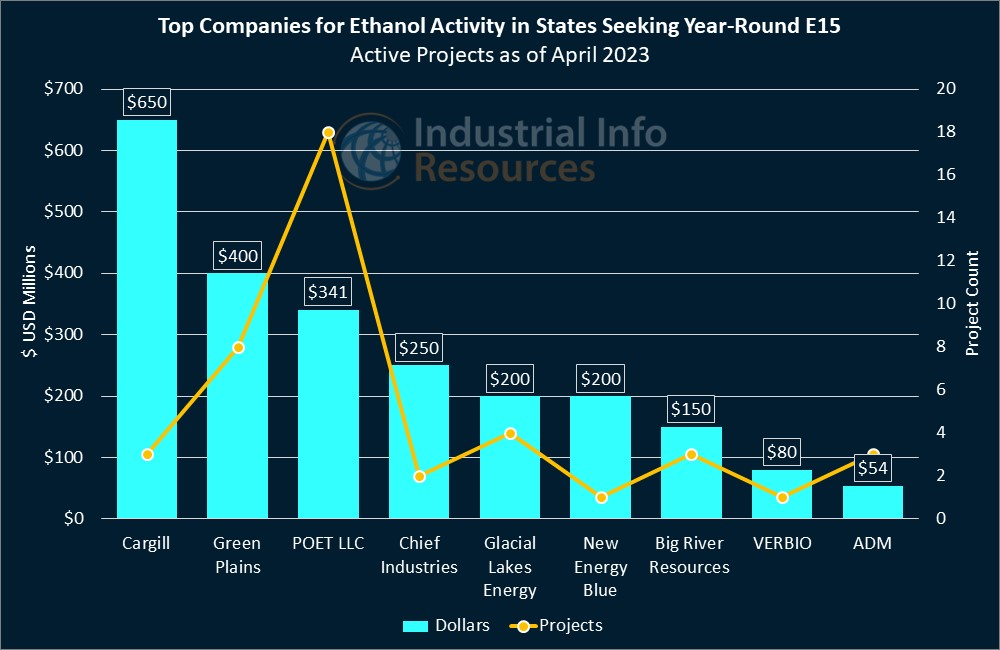

Iowa, often seen as the capital of the U.S. ethanol market, leads the eight states in ethanol-related investments, with about $1.9 billion in active projects. These include three from Cargill Incorporated (Minnetonka, Minnesota), which leads all other parent companies in investments across these eight states. Cargill began construction on a $300 million expansion at its corn milling and ethanol plant in Eddyville in November 2021 and a $50 million expansion at its ethanol plant in Fort Dodge in August, and it is considering a butanediol-production unit addition at the Eddyville site.

Subscribers to Industrial Info's Global Market Intelligence (GMI) Project Database can read detailed reports on the Eddyville and Fort Dodge expansions, and the proposed butanediol unit at Eddyville.

Ethanol producers have at least one thing in common with fossil-fuel giants: Many are turning to carbon capture and sequestration (CCS) projects to negate emissions from their facilities. Green Plains Incorporated (NASDAQ:GPRE) (Omaha, Nebraska), one of the three largest ethanol producers in North America, is investing heavily in these projects across Nebraska; it is seeking permits for CCS unit additions at its plants in Atkinson, Wood River and York, Nebraska, which could begin construction as early as next year. Subscribers can read detailed reports on the proposed CCS units in Atkinson, Wood River and York.

Two smaller expansion projects in the Midwest are expected to wrap up later this year: VERBIO Vereinigte BioEnergie AG's (Leipzig, Germany) $80 million ethanol unit addition at its renewable natural gas (RNG) plant in Nevada, Iowa, and Archer Daniels Midland Company's (NYSE:ADM) (Chicago, Illinois) $40 million expansion of its wet corn mill and ethanol production plant in Marshall, Minnesota. Subscribers can learn more from Industrial Info's reports on the Iowa and Minnesota projects.

Still, E15 has ways to go before it is embraced widely by U.S. consumers. According to the U.S. Department of Energy, just more than 2,500 gas stations in 31 states offer E15, and a long list of commonly used vehicles are prohibited from using the fuel: motorcycles; all vehicles with heavy-duty engines, such as school buses and delivery trucks; off-road vehicles, such as boats and snowmobiles; and anything with an engine made before 2001.

And the financial benefit for drivers using E15 instead of other blends--a refrain commonly heard from politicians in both major U.S. parties--often is negligible. President Joe Biden suspended the rule in the summer of 2022, when gasoline prices were battering consumers' pocketbooks; although market factors gradually reduced prices in the months to come, E15 is not believed to have had any meaningful effect. For more information, see April 15, 2022, article - Could Summer E15 Gasoline Waiver Impact Ethanol Plant Turnarounds?.

The Trump administration also allowed E15 to be sold during the summers of 2019-21, but only a tiny amount ended up in drivers' tanks. In any case, the U.S. Court of Appeals for the District of Columbia Circuit ruled in 2021 that Trump's EPA had overstepped its authority in allowing the sales. The Biden administration aims to avoid this barrier by using an emergency waiver, citing a difficult market for global fuels caused by the war in Ukraine.