U.S. Natural Gas Plants Feel the Heat, Prep for Maintenance

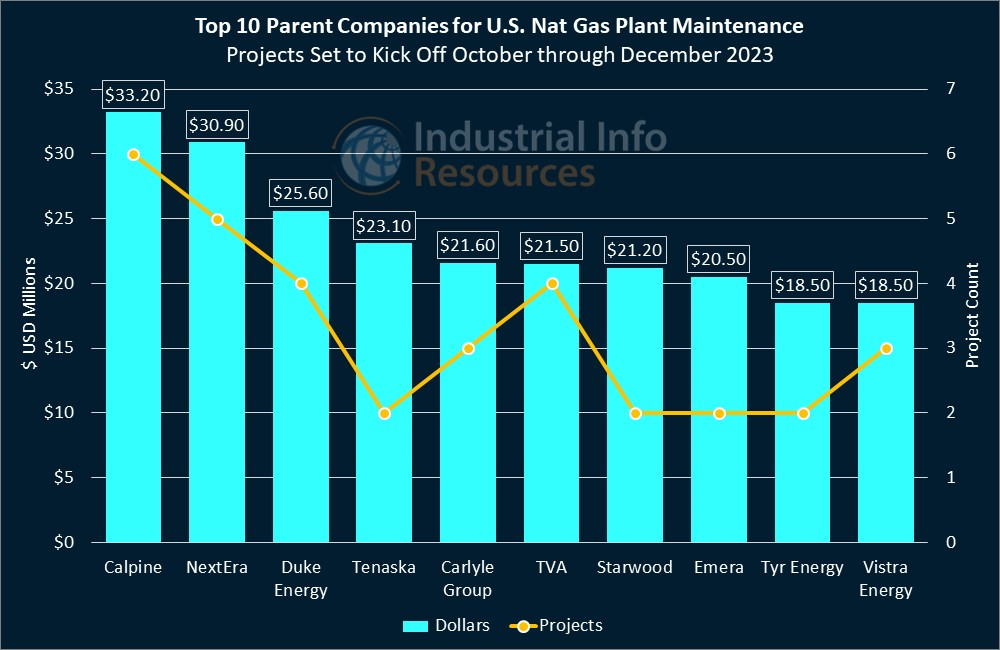

You've noticed it's hot outside, right? With a massive heat dome blanketing much of the U.S. and keeping temperatures for tens of millions of Americans in the triple-digit range, natural gas-fired power plants--which account for about 40% of domestic power generation--have their work cut out for them. With summers like these, run-time hours at these power plants stack up quickly, which could hasten the need for maintenance activity like hot gas path inspections and major overhauls. Industrial Info is tracking roughly 100 maintenance-related projects, totaling more than $565 million in value, at U.S. gas-fired power plants that are set to kick off from October through December.

Calpine Corporation (Houston, Texas) leads all other companies in its total investment in fourth-quarter maintenance kickoffs, with projects planned for two of the three U.S. states with the most activity. On the Texas Gulf Coast, Block 1 at the Channel Energy Center in Pasadena--which is a 769-megawatt (MW), natural gas-fired, combined-cycle (NGCC) unit--is set for a 30-day outage for a hot gas path inspection and repairs, while Calpine's 612-MW Unit 1 at the Jack Fusco Energy Center in Richmond, another NGCC unit, is preparing for 35 days of turbine inspections and repairs.

Both of Calpine's outages in Texas are set to begin in October and finish in mid-to-late November. Subscribers to Industrial Info's Global Market Intelligence (GMI) Power Project Database can learn more from detailed reports on the Pasadena and Richmond projects.

In Pennsylvania, which trails only Texas and Florida in its total investment in fourth-quarter maintenance kickoffs at gas-fired plants, Calpine is preparing to begin outages on the 666-MW Block 1 at the York Energy Center in Delta, as well as blocks 1 and 2 at its power plant in Bethlehem, which have a combined output of 1,152 MW. All three are NGCC units; the Bethlehem facility is a "mid-merit" power-generation plant, which adjusts its output as demand for electricity fluctuates throughout the day. Subscribers can read detailed reports on the Delta and Bethlehem projects.

NextEra Energy Incorporated (NYSE:NEE) (Juno Beach, Florida) is preparing for a series of maintenance kickoffs across Florida, where its subsidiary Florida Power & Light Company (FPL) services more than half of the state. FPL is planning for outages at four of its NGCC plants:

- units 8C and 8D at the Martin County Power Station in Indiantown, which have a total output of 376 MW; see project report

- the 436-MW Unit 5 at the Sanford Power Station in Debary; see project report

- the 1,326-MW Block 5 at the Clean Energy Center in Riviera Beach; see project report

- the 721-MW Unit 2 at the power station in Fort Myers; see project report

Duke Energy Corporation (NYSE:DUK) (Charlotte, North Carolina), the largest energy provider in North Carolina, is preparing for three outages in its home state, two of which are NGCC units: the 295-MW Unit 3 at the Asheville Power Station in Arden, which is expected to take 24 days, and the single-unit, 691-MW Dan River Power Station in Eden, which is expected to take 21 days. Both NGCC outages are expected to take place within October. Subscribers can learn more from detailed reports on the Arden and Eden projects.

Duke also is preparing for an outage at the 162-MW Unit 5 at the Rockingham County Power Station in Reidsville, North Carolina, which is a simple-cycle combustion turbine unit. At a projected 20 days, it has the shortest downtime slated for any of Duke's fourth-quarter maintenance kickoffs. Subscribers can learn more from Industrial Info's project report.

"We do expect to see healthy investment toward scheduled maintenance of gas turbines later this year, and I believe we can expect this to continue for the next few years," said Britt Burt, Industrial Info's vice president of research for the Global Power Industry. "This uptick in maintenance spending is due primarily to the number of gas turbines built in recent years that are coming due for maintenance. Just since the end of 2019, we have seen 201 units and more than 26 GW of natural gas-fired combustion turbines start commercial operation. This is just a fraction of the 597 units and 70 GW that have started operation since the end of 2012. These figures only represent capacity from combustion turbines, and do not include associated capacity from steam turbines in combined cycle operation."

Subscribers to Industrial Info's GMI Project Database can click here for a full list of detailed reports for projects mentioned in this article, and click here for a full list of related plant profiles.

Subscribers can click here for a full list of reports for maintenance-related projects at U.S. gas-fired power plants that are set to kick off in fourth-quarter 2023.