Reports related to this article:

Project(s): View 3 related projects in Energy Live

Plant(s): View 3 related plants in Energy Live

Researched by Industrial Info Resources (Sugar Land, Texas)--Industrial Info is tracking more than $2.5 billion in wind power project starts that are set to kick off from September through December 2016. Many developers are racing to begin construction before the end of 2016 in order to obtain full value of the federal government's production tax credit (PTC), which provides $0.023 per kilowatt-hour of generation for facilities beginning construction this year, but begins phasing down in value for facilities that begin construction in 2017 or later.

The 11 projects being tracked by Industrial Info are all quite large, ranging from a $110 million, 65-megawatt (MW) windfarm expansion in Oklahoma up to a $460 million, 230-MW expansion in Texas. This large project is the Phase II expansion of a possible 1,200-MW windfarm, which will include the construction of 115 turbines, each with a capacity of 2 MW. Construction is planned to kick off in November and take about a year to complete.

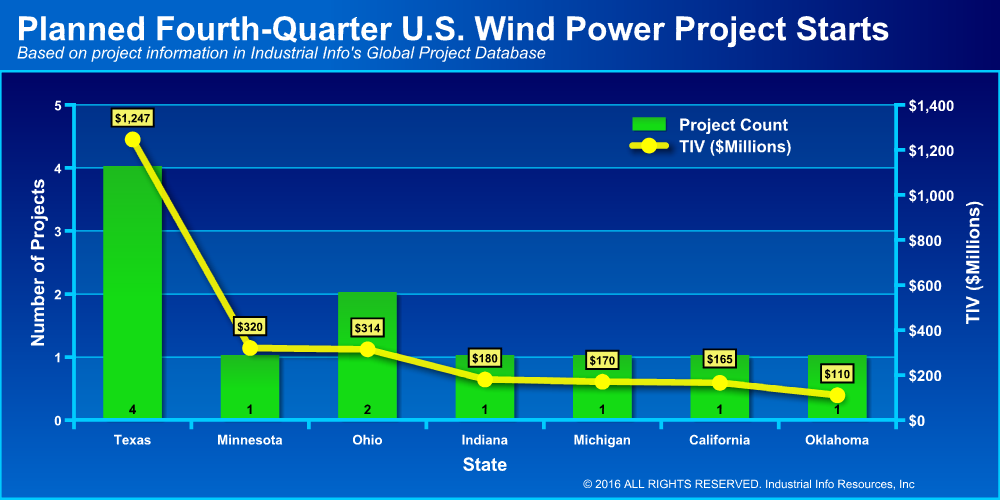

Geographically, the Southwest region, which includes Texas, leads the U.S. in both the number and value of projects planned to kick off during the quarter, with five projects valued at $1.36 billion. This is followed by the Great Lakes region with four projects valued at $664 million.

Click on the image at right for a breakdown by states of planned fourth-quarter wind power project starts in the U.S.

Click on the image at right for a breakdown by states of planned fourth-quarter wind power project starts in the U.S.In the Great Lakes region, the largest project planned to kick off during the quarter is the 100.8-MW Northwest Ohio Wind Energy Farm, which is being constructed by Starwood Energy Group (Greenwich, Connecticut) near Grover Hill, Ohio. The project will include the construction of 48 Gamesa wind turbine generators, each with a capacity of 2.1 MW, along with balance-of-plant equipment. Construction of the $202 million project is planned to kick off before the end of the year and take about 10 months to complete.

In 2017, the PTC amount will be reduced by 20%, and then an additional 20% each year through 2019, putting a construction policy of "the sooner, the better" in place for U.S. windfarms. So far, Industrial Info is tracking $46.5 billion of wind projects that are planned to kick off in the U.S. in 2017, including very elusive (for the U.S.) offshore windfarms.

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and 10 international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. Follow IIR on: Facebook - Twitter - LinkedIn. For more information on our coverage, send inquiries to info@industrialinfo.com or visit us online at http://www.industrialinfo.com.

/iirenergy/industry-news/article.jsp

false

Want More IIR News?

Make us a Preferred Source on Google to see more of us when you search.

Add Us On GoogleAsk Us

Have a question for our staff?

Submit a question and one of our experts will be happy to assist you.

Explore Our EnergyLive Tools

EnergyLive Tools provide instant insight into new build, outages, maintenance, and capacity shifts across key energy sectors.

Learn MoreRelated Articles

-

AWEA: COVID-19 Jeopardizes Windfarm Power ProjectsApril 14, 2020

-

Corporate America's Electricity Supply Growing GreenerFebruary 26, 2018

-

Southwest Region Leads U.S. for Value of 2018 Project StartsDecember 21, 2017

-

Enel Green Power Completes Three Major Wind Power ProjectsDecember 30, 2016

Explore Our Enery Industry Reports

Gain the competitive edge with IIR Energy’s suite of energy market reports, designed for traders, analysts, and asset managers who rely on verified, real-time data.

Learn MoreIndustry Intel

-

From Data to Decisions: How IIR Energy Helps Navigate Market VolatilityOn-Demand Podcast / Nov. 18, 2025

-

Navigating the Hydrogen Horizon: Trends in Blue and Green EnergyOn-Demand Podcast / Nov. 3, 2025

-

ESG Trends & Challenges in Latin AmericaOn-Demand Podcast / Nov. 3, 2025

-

2025 European Transportation & Biofuels Spending OutlookOn-Demand Podcast / Oct. 27, 2025

-

2025 Global Oil & Gas Project Spending OutlookOn-Demand Podcast / Oct. 24, 2025