Production

Then & Now: Continental Resources Cuts Costs, Boosts Outlook, but Losses Grow

It looks like Saudi Arabia blinked first. When the desert kingdom ramped up its oil production in late 2014, causing crude-oil prices to collapse, many observers predicted U.S. Oil & Gas producers would quickly fold, victimized by their high debt load and high-cost structure.

Written by John Egan for Industrial Info Resources (Sugar Land, Texas)--It looks like Saudi Arabia blinked first. When the desert kingdom ramped up its oil production in late 2014, causing crude-oil prices to collapse, many observers predicted U.S. Oil & Gas producers would quickly fold, victimized by their high debt load and high-cost structure.

Two years later, in late 2016, Saudi Arabia and the other members of the Organization of the Petroleum Exporting Countries (OPEC) agreed to cut crude-oil production by about 1.2 million barrels per day (BBL/d) of oil, effective this month. That was the first time the cartel agreed to reduce production since 2008. A few days after the November 30 OPEC meeting, a group of non-OPEC countries agreed to reduce crude-oil production by about 600,000 BBL/d, also effective January 1.

Crude-oil prices have soared about 25% since mid-November in response to rumors, and then confirmations, of the production cuts. At a recent price of about $54 per barrel, West Texas Intermediate (WTI), the U.S. benchmark, is less than half of its peak in mid-2014, when the Saudis began to turn on the spigot and flood the global market with crude oil.

OPEC may have succeeded in winning market share by flooding the market, but the predicted collapse of unconventional crude-oil producers in the U.S. didn't happen. Production from unconventional formations in the U.S. is down less than 10% from its peak, according to the U.S. Energy Information Administration (EIA) (Washington, D.C.). And while higher prices have buoyed the prospects of independent Oil & Gas producers, no one is claiming victory just yet. In a series of articles, we will look at the steps some of the largest independent producers have taken over the last 24 months to become more competitive.

Mark Twain's famous quip--the reports of my death have been greatly exaggerated--aptly summarizes crude-oil production from the seven major unconventional formations in the U.S. According to data from the EIA's Drilling Productivity Reports, production from those formations rose from slightly more than 1 million BBL/d in January 2007 to more than 5 million BBL/d in January 2015, a level it held for most of 2015 and 2016, before declining to about 4.5 million BBL/d in January 2017. Continued high levels of production for most of the two-year price slump defied the predictions of many experts.

If crude-oil prices remain stably above $50 per barrel, it's a good bet that production will begin to grow. Assuming some price stability, and continued strong global demand, production could begin rising this year as producers resume production from shut-in wells, as well as complete some of their large backlog of drilled but uncompleted (DUC) wells. According to EIA, there were 5,219 DUC wells as of November 2016, a dramatic increase over the 3,709 DUC wells that existed in December 2013, when the agency started tracking DUCs.

In fact, the backlog of DUC wells has been declining for most of 2016. DUC wells peaked at 5,517 in March 2016, and have fallen steadily to 5,219 as of November 2016, according to EIA. Nearly all of those declines in DUC wells--about 267--took place in the Eagle Ford shale formation in Texas.

The challenge facing producers is to resist the temptation to flood the market with product, which would overwhelm demand growth, undercut price stability and plunge crude oil back to where it was in late 2014, after the Saudis opened the spigots.

Continental Resources Incorporated (NYSE:CLR) (Oklahoma City, Oklahoma) is often seen as a bellwether independent producer when it comes to unconventional formations. Operating mainly in North Dakota's Bakken formation, but with a growing presence in Oklahoma's SCOOP and STACK plays, Continental was among the first companies to identify and profit from unconventional oil & gas. For more on Continental's SCOOP and STACK plays in Oklahoma, see December 4, 2013, article - SCOOP and STACK are Hot New Plays for Oklahoma Oil & Gas Drilling. For more recent coverage of Continental, see June 9, 2014, article -Continental Resources Goes Beyond Bakken Shale to Explore Three Forks Potential and December 28, 2015, article - Continental Resources Sees Higher Prices in First Half of 2016, Cuts Costs, Boosts Production as it Waits for Higher Oil Prices.

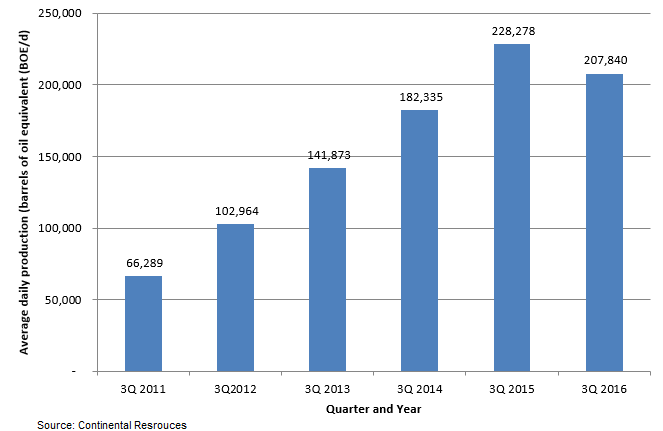

Continental's production soared from about 66,000 BBL/d during the third quarter of 2011 to about 228,000 BBL/d during the third quarter of 2015, before dropping off to about 207,000 BBL/d during the third quarter of 2016, according to the company's financial statements. It predicted overall daily production for 2016 will be between 215,000 barrels of oil equivalent per day (BOE/d) and 220,000 BOE/d, it said November 2.

Click on the image at right to see crude oil production from Continental Resources.

Click on the image at right to see crude oil production from Continental Resources. Last year, investors hungered for Continental's stock, pushing it up about 124%, making it one of the biggest gainers of 2016, in or out of the Oil Patch. The common stocks of many of Continental's peer independent producers rose about 40% last year, by contrast, and some, like Noble Energy Incorporated (NYSE:NBL) (Houston, Texas) and ConocoPhillips (NYSE:COP) (Houston, Texas), did considerably worse than that.

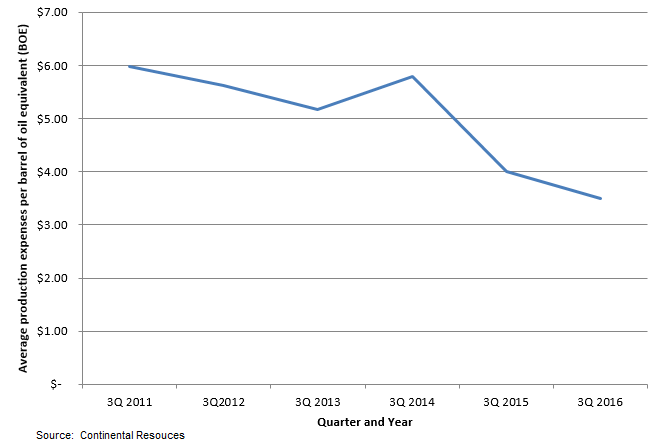

Over the last six years, Continental's cut by over 40% its production expense per BOE, from nearly $6 per BOE in the third quarter of 2011 to about $3.50 per BOE in the third quarter of 2016, the company said in its quarterly earnings reports.

Click on the image at right to see a table with Continental's declining production costs.

Click on the image at right to see a table with Continental's declining production costs. When it reported third-quarter earnings this past November, Continental officials said they would increase its full-year 2016 capital budget (excluding acquisitions) to about $1.1 billion, up approximately 20% from what it told investors three months earlier, in August 2016, when it projected non-acquisition capital spending of about $920 for 2016.

Continental raised some eyebrows in late 2014 when it liquidated all of its oil hedges, thinking either the crude-oil price decline then gathering steam was a short-term phenomenon or that it could get more on the open market for its products than it could by locking in pre-determined production levels at a set price. It was wrong, and that decision cost the company an estimated $1 billion.

Like most oilmen, Continental's leaders are nothing if not optimistic. The company continues to lose money as it waits for the expected better days to materialize. Its net losses for the third quarter were about $110 million, up from approximately $82 million in the comparable year-earlier quarter. Quarterly revenue fell to $506 million compared to $628 million in the third quarter of 2015. For the first nine months of 2016, it lost $427 million compared to losses of $214 million in the comparable year-earlier period. For the first three quarters of 2016, revenue was $1.4 billion, down 28% from the comparable year-earlier period of $2 billion.

"We have expanded the productive footprint of STACK, SCOOP and the Bakken core, and are increasing the value of these assets with density testing and enhanced completions," Harold Hamm, Continental's chairman and chief executive said November 2 in announcing third-quarter results. "The results of the Ludwig density test in STACK have given us confidence to begin development on acreage we have de-risked in the over-pressured oil window."

"Additionally," Hamm continued, "we brought on several excellent producers in the Bakken using enhanced completion designs, including two wells that generated CLR-record 30-day initial rates for the Bakken. This is an encouraging start as the Company begins working down its large backlog of Bakken uncompleted wells and capturing their value."

"I'm a big fan of Continental, mainly because Harold Hamm saw opportunity where others didn't when he began developing the Bakken," said Jesus Davis, Industrial Info's vice president of research for the Oil & Gas Production, Pipelines and Terminals industries. "Unless prices fall sharply, I see Continental drawing down on its backlog of DUC wells in 2017. In the right pricing environment, it could report profits this year."

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and 10 international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. Follow IIR on: Facebook - Twitter - LinkedIn. For more information on our coverage, send inquiries to info@industrialinfo.com or visit us online at http://www.industrialinfo.com.

Want More IIR News?

Make us a Preferred Source on Google to see more of us when you search.

Add Us On GoogleAsk Us

Have a question for our staff?

Submit a question and one of our experts will be happy to assist you.

Forecasts & Analytical Solutions

Where global project and asset data meets advanced analytics for smarter market sizing and forecasting.

Learn MoreRelated Articles

-

Venezuelan Refinery Capacity at 750,000 BBL/dFebruary 04, 2026

-

Permian Gas Production to IncreaseFebruary 04, 2026

-

Devon-Coterra $58 Billion Tie-up Targets Large Inventory of ...February 03, 2026

-

Texas LNG Closer to FID with New FinancingFebruary 03, 2026

Industrial Project Opportunity Database and Project Leads

Get access to verified capital and maintenance project leads to power your growth.

Learn MoreIndustry Intel

-

From Data to Decisions: How IIR Energy Helps Navigate Market VolatilityOn-Demand Podcast / Nov. 18, 2025

-

Navigating the Hydrogen Horizon: Trends in Blue and Green EnergyOn-Demand Podcast / Nov. 3, 2025

-

ESG Trends & Challenges in Latin AmericaOn-Demand Podcast / Nov. 3, 2025

-

2025 European Transportation & Biofuels Spending OutlookOn-Demand Podcast / Oct. 27, 2025

-

2025 Global Oil & Gas Project Spending OutlookOn-Demand Podcast / Oct. 24, 2025