Power

Moody's: Marcellus Gas 'Wreaks Havoc' on PJM Merchant Generators

The PJM Interconnection (Valley Forge, Pennsylvania) has become a killing field for older, less-efficient merchant power plants, and conditions there likely will get worse before they better, according to a recent report by Moody's Investors Service (New York, New York), a unit of Moody's Corporation (NYSE:MCO) (New York, New York).

Reports related to this article:

Written by John Egan for Industrial Info Resources (Sugar Land, Texas)--The PJM Interconnection (Valley Forge, Pennsylvania) has become a killing field for older, less-efficient merchant power plants, and conditions there likely will get worse before they better, according to a recent report by Moody's Investors Service (New York, New York), a unit of Moody's Corporation (NYSE:MCO) (New York, New York).

PJM is the regional grid operator responsible for scheduling power for an estimated 65 million customers in 13 Mid-Atlantic and Midwestern states and the District of Columbia. It is the nation's largest regional power market, stretching from New Jersey to North Carolina and Illinois to Kentucky. Heightened power plant competition, driven by abundant, low-cost natural gas, likely will hold down electric prices for customers living in the PJM region.

The bond-rating agency's report, "Marcellus Shale Gas Buildout Wreaks Havoc on PJM Power Market," said "a massive construction of new gas capacity is underway in PJM to take advantage of cheap Marcellus gas, which will drive down market prices" and damage the credit worthiness for merchant generators in the area. For a profile of Cabot Oil & Gas Corporation, the leading gas producer in the Marcellus Shale, see January 12, 2017, article - Then & Now: Cabot Oil & Gas Keeps Growing Production, Waits for Pipelines. For more on new electric generation construction across the U.S., see April 7, 2017, article - U.S. Generators Added 15,000 Net Megawatts of New Generation in 2016 and February 13, 2017, article - Gas-Fired Power Development Expected to Surge Across North America.

The Moody's report noted the "rush to build new gas plants (will) create (a) power supply glut" in PJM. New generating stations are expected to increase PJM's peak electric generation by about 25% by 2021, but "the increased supply comes amid little prospect of growth in demand," it forecast. The new plants will depress PJM's wholesale power prices by between 10% and 15% starting in 2021, Moody's added.

The gas buildout also will force the closure of coal-fired generation or its conversion to natural gas, the report predicted. It said the companies with the largest fleets of merchant coal-fired generation in the region include units of Talen Energy (Allentown, Pennsylvania), FirstEnergy Corporation (NYSE:FE) (Akron, Ohio), NRG Energy (NYSE:NRG) (Princeton, New Jersey) and Dynegy Incorporated (NYSE:DYN) (Houston, Texas). "Gas conversion is not a panacea for uneconomic coal plants," Moody's said, "because the converted units will have poor fuel efficiency and operate as peaking units."

Nuclear subsidies "are a wild card," the report said, noting New York and Illinois enacted financial aid packages for nuclear generators last year. Those moves are being challenged in court. If those challenges succeed, the prospects for nuclear grow even dimmer, but successful challenges to nuclear support could end up improving the outlook for coal in PJM, Moody's said. Late last month, Exelon Corporation (NYSE:EXC) (Chicago, Illinois) announced it was closing its two-unit Three Mile Island Nuclear Generating Station in 2019 because it was uneconomic. For more on that, see May 31, 2017, article - U.S. Nuclear Power Market Woes Continue: Three Mile Island to Close in 2019.

FirstEnergy is waging an uphill battle for up to $300 million per year in fees to recognize the non-emitting nature of the two nuclear units it operates in Ohio. The utility also is seeking similar financial support for its two-unit Beaver Valley Nuclear Power Station in Pennsylvania. For more on that, see May 30, 2017, article - Down but Not Out? FirstEnergy Still Seeking $300 Million Per Year in Nuclear Support.

"According to PJM's latest forecast, load growth and peak demand have declined over the last 10 years," Toby Shea, a vice president and senior credit officer at Moody's, said in a statement on releasing the report May 8. "The market imbalance will drive down prices and pose challenges to generators operating on thin margins. We believe that 7,000 megawatts (MW) of high-risk coal plants will shut down, along with some of the medium-risk plants."

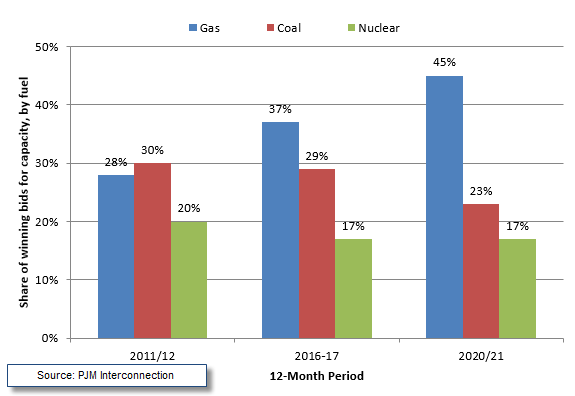

The findings of the Moody's report were confirmed by results from PJM's most recent power auction, which were made public about two weeks after the credit-rating agency's report was released. In bidding to supply electricity to PJM for a 12-month period spanning 2020-2021, gas-fired plants captured about 45% of the market, supplying 73,761 MW of capacity out of a total of 165,507 MW. Gas' share of the PJM capacity market has risen steadily as gas production from the Marcellus Shale has grown over the prior decade while the shares of coal and nuclear have fallen, PJM said.

Click on the image at right to see which fuels have won what percentage of bids in PJM since 2011-12.

Click on the image at right to see which fuels have won what percentage of bids in PJM since 2011-12.The PJM market also is experiencing a burst of transmission construction. Earlier this year, the grid manager authorized construction of about $1.5 billion of new projects to strengthen and expand the region's transmission network. This continues years of hefty transmission spending in the region.

The in-service dates of transmission projects can sometimes hasten, or postpone, the closure of older generating capacity. For example, earlier this year, the 450-MW B.L. England Power Station in New Jersey was given a reprieve lasting at least two years until certain PJM transmission projects could be completed. In 2014, R.C. Cape May Holdings LLC (Marmora, New Jersey), the plant's owner, decided to close the plant in 2015. But in two separate decisions, PJM ordered it to remain operating, first until May 2017 and then until June 2019. The plant began operating in 1961.

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and 10 international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. Follow IIR on: Facebook - Twitter - LinkedIn. For more information on our coverage, send inquiries to info@industrialinfo.com or visit us online at http://www.industrialinfo.com.

Want More IIR News?

Make us a Preferred Source on Google to see more of us when you search.

Add Us On GoogleAsk Us

Have a question for our staff?

Submit a question and one of our experts will be happy to assist you.

Forecasts & Analytical Solutions

Where global project and asset data meets advanced analytics for smarter market sizing and forecasting.

Learn MoreRelated Articles

-

Meta Boosts Nuclear Agreements, Adds Vistra, TerraPower, Okl...January 13, 2026

-

Constellation Energy Completes Calpine AcquisitionJanuary 09, 2026

-

Meta Advances Efforts to Power AI Data CentersNovember 14, 2025

-

Closed U.S. Nuclear Plant Reaches Another Reopening Mileston...October 22, 2025

-

Conference: Nuclear is in Great Shape to Power U.S., Texas G...September 08, 2025

Industrial Project Opportunity Database and Project Leads

Get access to verified capital and maintenance project leads to power your growth.

Learn MoreIndustry Intel

-

From Data to Decisions: How IIR Energy Helps Navigate Market VolatilityOn-Demand Podcast / Nov. 18, 2025

-

Navigating the Hydrogen Horizon: Trends in Blue and Green EnergyOn-Demand Podcast / Nov. 3, 2025

-

ESG Trends & Challenges in Latin AmericaOn-Demand Podcast / Nov. 3, 2025

-

2025 European Transportation & Biofuels Spending OutlookOn-Demand Podcast / Oct. 27, 2025

-

2025 Global Oil & Gas Project Spending OutlookOn-Demand Podcast / Oct. 24, 2025