Metals & Minerals

Glum and Glummer: BP Sees Bleak Global Outlook for Coal Through 2035

The global coal industry had a bad 2016, and it's future may get even more glum, according to the recently released BP Statistical Review of World Energy.

Released Tuesday, June 20, 2017

Written by John Egan for Industrial Info Resources (Sugar Land, Texas)--The global Coal Industry had a bad 2016, and its future may get even more glum, according to the recently released BP Statistical Review of World Energy.

"The fortunes of coal appear to have taken a decisive break from the past," Spencer Dale, group chief economist at BP plc (NYSE:BP) (London, England), said June 13 in discussing the release of BP's long-term forecast of global energy supply and demand through 2035. "At the heart of this shift are structural, long-term, factors: the increasing availability and competitiveness of natural gas and renewable energy; combined with mounting government and societal pressure to shift away from coal towards cleaner, lower-carbon fuels. These long-term forces in turn have given rise to policy responses that have often added even greater momentum."

The declining prospects for coal, coupled with the rise of renewable energy around the world, was a key trend highlighted in the BP study. A significant amount of coal's current and future challenges are tied to the dramatic slowdown in demand in China, still the world's largest consumer of coal, and in the United States, Dale noted.

Last year, China implemented policies designed to foster a more sustainable pattern of economic growth, reduce reliance on coal-fired power and shift towards cleaner, lower-carbon fuels, BP said in its energy outlook. That nation still is expected to remain the world's largest single market for coal, but demand is expected to plateau over the next 20 years, a "sharp contrast to the rapid, industrialization-fueled growth of much of the past 20 years," the report said.

In 2016, Chinese leaders introduced a series of measures to reduce the scale of excess capacity in the domestic coal sector and improve the productivity and profitability of the remaining mines, Dale said. "These measures were focused on reducing capacity amongst the smallest, least-productive mines and encouraging greater consolidation. In addition, the government further constrained production by restricting coal mines to operate for a maximum of 276 days, down from 330 days."

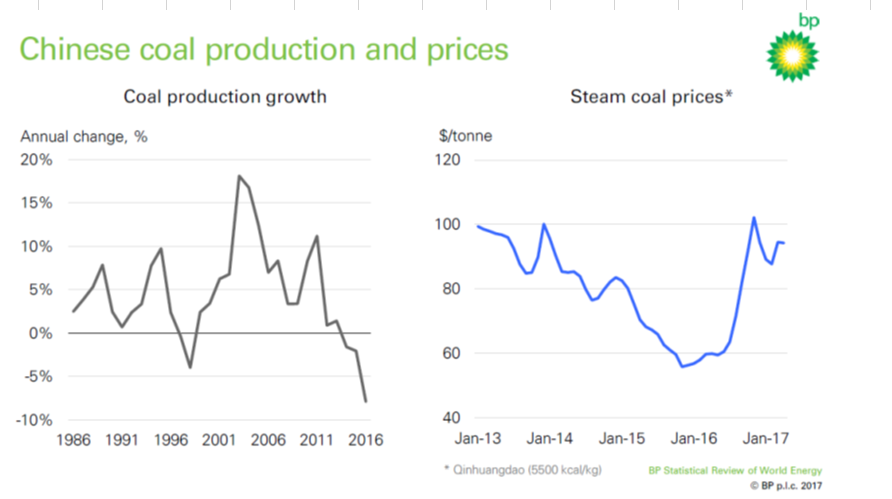

Dale noted the impact of these measures was dramatic: China's domestic coal production fell sharply, pushing prices up dramatically. By mid-2016, Chinese authorities took a series of steps to relax the 276-day production policy, and in early 2017 tried to establish explicit price bands for domestic coal, Dale said.

Click on image at right to see a graphic on how China's coal production fell, and prices rose, in 2016.

Click on image at right to see a graphic on how China's coal production fell, and prices rose, in 2016.Despite China's mid-2016 relaxation of its coal policies, Dale continued, these measures had a marked impact on the Chinese coal market. Production fell by almost 8%, roughly 140 million tonnes of oil equivalent (Mtoe), by far the largest decline on record. The price of steam coal rose by more than 60% during 2016. Coal consumption also declined for the third consecutive year, although by less than production. At yearend 2016, China resumed its role as the world's largest importer of coal, Dale said in a worldwide webcast June 13.

What happened in China has affected global coal markets. Last year was the second consecutive year when global coal consumption fell, declining 1.7% or about 53 million tonnes of oil equivalent (Mtoe), BP said in its outlook report. Pacing this global decline was China, where coal demand fell 1.6%, or 26 Mtoe, and the U.S., where consumption fell 8.8%, about 33 Mtoe.

Global prices took their cue from China last year, the BP executive noted: Rising world prices cut into demand, particularly among electric generators, and gas-fired and renewable power were more than happy to step in as substitute fuels. Global coal consumption fell by 53 Mtoe, or about 1.7%, and global production dropped a "whopping" 231 Mtoe, roughly 6.2%, he said, adding U.S. coal production registered a second consecutive substantial fall, down 19%,or about 85 Mtoe, to 364.8 Mtoe in 2016. U.S. coal production in 2016 was the lowest since BP began tracking data for that fuel in 1981.

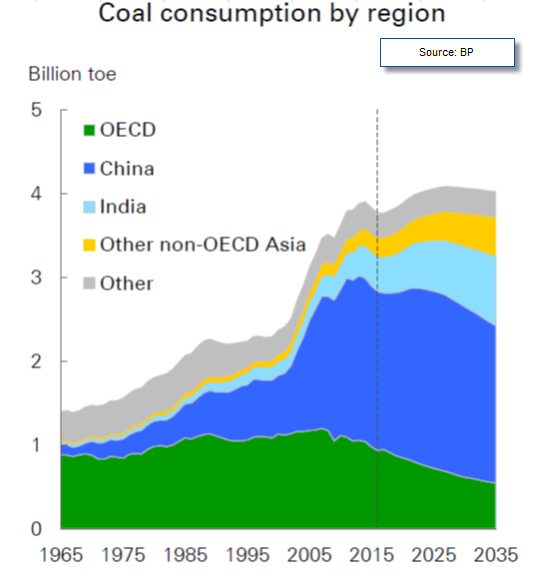

The recent market difficulties facing coal set the stage for a long-term decline in the black rock's fortunes, according to BP analysis. Looking out to 2035, the company's economists predict global coal demand growth will average 0.2% per year, down dramatically from annual demand growth of 2.7% per year over the prior 20 years. The energy outlook further predicted global coal consumption will peak in the mid-2020s.

As demand slackens in China and the U.S. for coal, India will become the world's largest growth market for that fuel, Dale projected. India's share of the global coal market is expected to rise to 20% by 2035, a doubling of its 10% share in 2015. An estimated two-thirds of that demand growth will come from the power sector.

Meanwhile, coal consumption in the Organisation for Economic Cooperation and Development (OECD) counties is projected to fall more than 40% through 2035 as that fuel's share of the electric market is displaced by gas-fired and renewable generation.

Going forward, increased coal demand from India and non-OECD Asian countries is expected to more than offset declines in China and the OECD so that global demand slightly exceeds 4 billion TOE in the early 2030s.

Click on the image at right to see BP's forecast of global coal consumption trends through 2035.

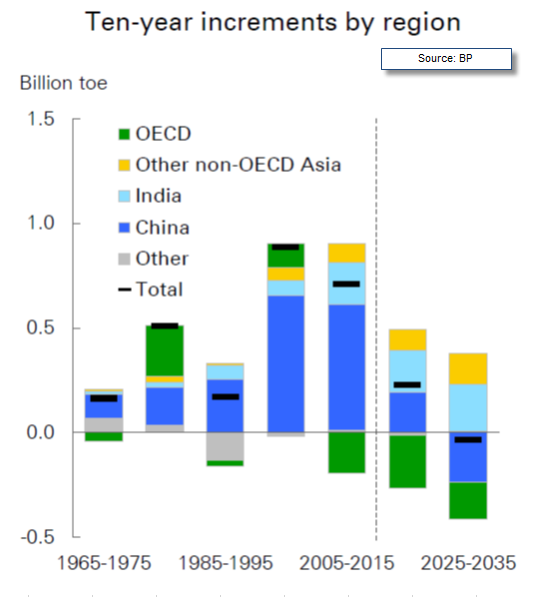

Click on the image at right to see BP's forecast of global coal consumption trends through 2035. Looking at demand growth for coal in different global regions, BP shows how strong demand growth by China over the prior 20 years supported global coal demand growth during that time. But with dramatic declines forecast in China's demand through 2035, coal faces a difficult future around the world, BP said.

Click on the image at right to see demand growth for coal by various global regions since 1965 and through 2035.

Click on the image at right to see demand growth for coal by various global regions since 1965 and through 2035. Turning back to his home country, the U.K., Dale said his nation's relationship with coal has just about come full circle: The U.K. closed its last three underground coal mines, consumption has fallen back to what it was about 200 years ago, and the U.K. power sector recorded its first-ever coal-free day in April of this year.

"Stability and energy markets don't go together," Dale commented, "like England and summer. Booms and busts, rebounds and reversals, are the norm."

"But the movements and volatility seen last year in energy markets were particularly interesting since they were driven by two separate forces: the continued adjustment to the short-run, cyclical, shocks that have rocked energy markets in recent years; overlaid by the growing gravitational pull from the longer-run energy transition that is under way."

Dale titled his remarks, "Energy in 2016: Short-run adjustments and long-run transition." Reflecting on those two forces, he noted, "these cyclical adjustment mechanisms are being increasingly affected by the longer-run transition that is shaping global energy markets. On the demand side: the shift in the center of gravity to fast-growing developing economies, led by China and India, together with a slowing in overall energy growth as it is used ever more efficiently. And on the supply side, the secular movement towards cleaner, lower-carbon energy, led by renewable energy, driven by environmental needs and technological advances."

The interplay of those two forces made for a volatile year in 2016, and BP sees more volatility, most likely to the downside, for coal from now until 2035. "The speed of deterioration in the fortunes of coal over the past few years has been stark," Dale commented. "It's only four years ago that coal was the largest source of global (energy) demand growth. I'm sure there will be further ups and downs in the fortunes of coal over coming years, but the scale of the declines in recent years do seem to signal a fairly decisive break from the past."

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and 10 international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. Follow IIR on: Facebook - Twitter - LinkedIn. For more information on our coverage, send inquiries to info@industrialinfo.com or visit us online at http://www.industrialinfo.com.

Want More IIR News?

Make us a Preferred Source on Google to see more of us when you search.

Add Us On GoogleAsk Us

Have a question for our staff?

Submit a question and one of our experts will be happy to assist you.

Forecasts & Analytical Solutions

Where global project and asset data meets advanced analytics for smarter market sizing and forecasting.

Learn MoreRelated Articles

-

British Columbia to Fast-Track Permitting on Three Critical ...February 26, 2026

-

Newmont-Barrick Nevada JV Tensions GrowFebruary 25, 2026

-

Copper Mining Projects Continue to Gain Traction in Argentin...February 25, 2026

-

India, Brazil Seek $20 Billion in Trade, with Mining in Key ...February 24, 2026

-

Spring 2026: Fading La Niña, Western Drought Risk, Eye on Hu...February 24, 2026

Industrial Project Opportunity Database and Project Leads

Get access to verified capital and maintenance project leads to power your growth.

Learn MoreIndustry Intel

-

From Data to Decisions: How IIR Energy Helps Navigate Market VolatilityOn-Demand Podcast / Nov. 18, 2025

-

Navigating the Hydrogen Horizon: Trends in Blue and Green EnergyOn-Demand Podcast / Nov. 3, 2025

-

ESG Trends & Challenges in Latin AmericaOn-Demand Podcast / Nov. 3, 2025

-

2025 European Transportation & Biofuels Spending OutlookOn-Demand Podcast / Oct. 27, 2025

-

2025 Global Oil & Gas Project Spending OutlookOn-Demand Podcast / Oct. 24, 2025