Reports related to this article:

Project(s): View 7 related projects in PECWeb

Plant(s): View 7 related plants in PECWeb

Released January 25, 2017 | SUGAR LAND

en

Written by John Egan for Industrial Info Resources (Sugar Land, Texas)--Automakers sold a record number of vehicles in the U.S. last year, and with vehicle-makers under pressure from President Donald Trump to build more cars and trucks domestically, 2017 could turn out to be a year of hefty domestic capital investments by automakers.

Consumers purchased a record 17.6 million new cars and trucks in 2016, slightly over the 17.5 million units that were sold in 2015, according to Autodata, which tracks vehicle sales. Analysts credited declining gas prices, hefty year-end incentives, an improving economy and low interest rates as factors behinds 2016's record sales year.

Whether 2017 unit sales will set a new record is an open question. But one thing seems clear: This year, a growing percentage of cars and trucks will be made in the U.S., if President Trump has anything to say about it.

And he has been vocal, mainly communicating his views via tweets posted to Twitter, first as a presidential candidate and then as president-elect. Trump promised to boost the U.S. economy by levying import fees on foreign-made goods, including tariffs of 35% on cars imported from Mexico.

He followed those words with deeds January 23 when he vetoed the Trans-Pacific Partnership (TPP), a trade agreement negotiated over several years with 11 other countries, including Japan, Australia, New Zealand, Mexico, Canada and other nations. Sean Spicer, the president's spokesman, said, "this executive action ushers in a new era of U.S. trade policy, in which the Trump administration will pursue bilateral trade opportunities with allies around the globe. The Trump administration wants free and fair trade throughout the world."

The next day, Tuesday, January 24, in advance of a meeting with the nation's largest carmakers, Trump tweeted, "I want new plants to be built here for cars sold here!" Then, during a meeting with the leaders of General Motors Company (NYSE:GM) (Detroit, Michigan), Ford Motor Company (NYSE:F) and Fiat Chrysler Automobiles NV (NYSE:FCAU) (London, United Kingdom), Trump told the automakers his administration will try to make it easier to build plants in the United States. He also assured them they were not the only companies and industries that were being lobbied to keep jobs in the U.S.: "You're not being singled out."

News reports after the meeting said the executives agreed to work with the new administration on items like tax, regulation, and trade policies. "There's a huge opportunity, working together as an industry," Mary Barra, chief executive at GM, said.

Some carmakers, including GM, Ford and Toyota Motor Corporation (NYSE:TM) (Toyota, Japan) were criticized by Trump in tweets for not building more vehicles in the U.S. Last week, after a critical tweet from Trump, GM agreed to invest an estimated $1 billion to create about 7,000 new jobs in the U.S. The jobs will be in manufacturing and information technology. GM denied the moves were in response to criticism from Trump.

Prior to Trump's election, GM had been aggressively investing in Mexico and laying off employees in the U.S., according to a report in the Detroit Free Press. Since late 2014, the newspaper reported, GM has announced more than $10 billion of investments and more than 5,000 new jobs in Mexico.

Trump also threatened Toyota with a "big border tax" if it went forward with its decision to build an assembly plant in Mexico to make Corollas for the U.S. market. Toyota held firm, but the tweet knocked about $2 billion off the automaker's market capitalization. A few days later, after the dust settled, Toyota said it planned to invest $10 billion over five years in the U.S., the same amount it has invested in the U.S. over the previous five years.

Carmakers also find themselves in the crosshairs when a Trump tweet is not factually accurate. Last November, for example, shortly after his election as president, Trump criticized Ford for its decision to close a Kentucky manufacturing facility and move jobs to Mexico. Ford said it never planned to close the facility, only to shift production of one model made there to Mexico. The Kentucky facility would make other models. Weeks later, Trump congratulated Ford for keeping the Kentucky plant open.

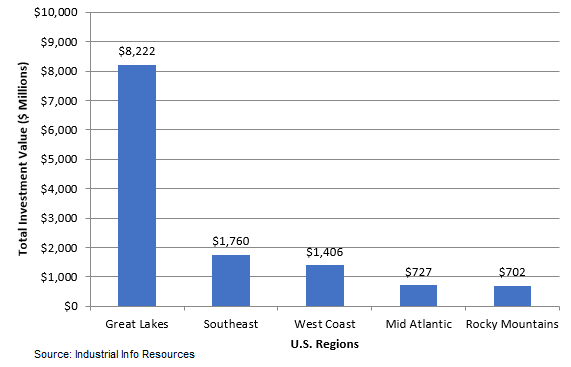

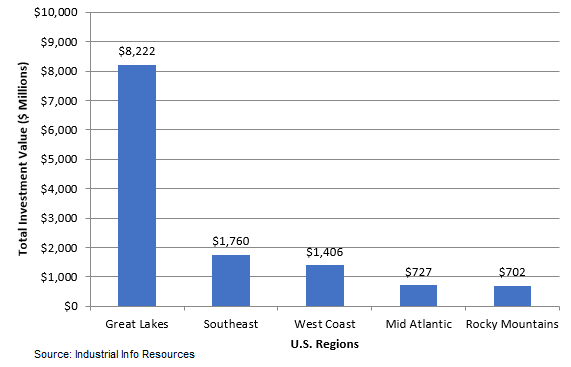

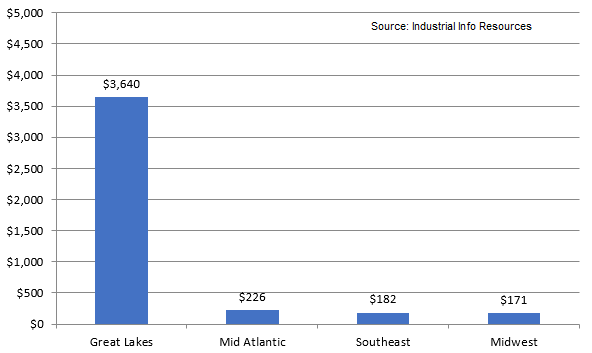

In the U.S., automakers have a total of 461 capital and maintenance projects scheduled to kick off in 2017 and 2018, with a total investment value of about $13.9 billion, according to Industrial Info's North American Project Platform. These projects include grassroot new assembly lines or component manufacturing factories, as well as expansion of existing plants. The Great Lakes region is expected to see the greatest amount of project activity, with about 229 projects worth $8.2 billion scheduled to begin construction in 2017 and 2018. The Southeast, West Coast and Mid-Atlantic regions trail the Great Lakes area for project activity over the next two years.

Click on the image at right to see a chart of U.S. regions with greatest dollar-value of project activity over the next two years.

Click on the image at right to see a chart of U.S. regions with greatest dollar-value of project activity over the next two years.

Some of the biggest domestic auto-related projects scheduled to begin construction between now and the end of 2018 include:

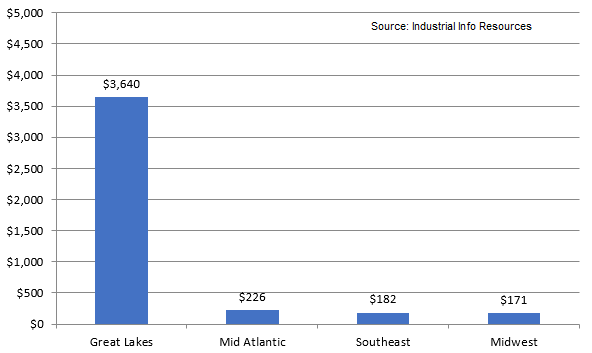

Click on the image at right to see a chart of U.S. regions with greatest dollar-value of auto industry projects scheduled to begin construction in 2015 and 2016 that were cancelled or placed on hold.

Click on the image at right to see a chart of U.S. regions with greatest dollar-value of auto industry projects scheduled to begin construction in 2015 and 2016 that were cancelled or placed on hold.

The vehicle manufacturing industry reportedly accounts for an estimated 20% of U.S. gross domestic product (GDP). A surge in investment in that industry may lead to more parts and cars being made domestically, but the impact on jobs may be less clear: many assembly plants rely more on robots than workers to assemble vehicles. So domestic investment could increase, and domestic production could increase, but automation on the factory floor may limit future assembly-line job growth.

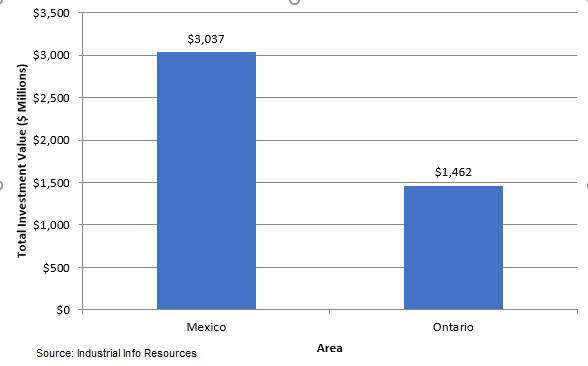

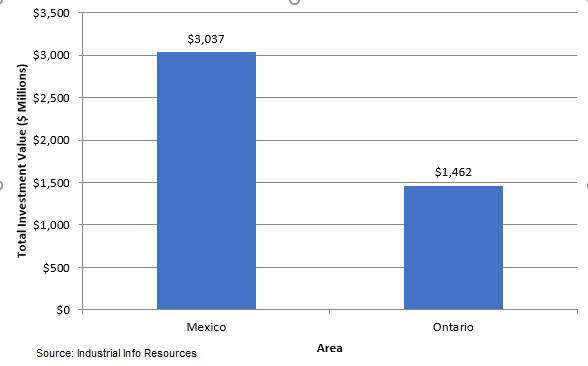

Whether Trump's automobile trade policies will affect carmakers' decisions to build cars or parts factories in Mexico or Canada remains an open question. Industrial Info is tracking 218 active automotive-related capital and maintenance projects valued at $4.5 billion that are scheduled to kick off construction this year or next year in Canada or Mexico. Canada is home to 120 projects valued at $1.5 billion. Another 98 projects, valued at about $3 billion, are scheduled to be built in Mexico. Units of Volkswagen, Toyota and Mazda are scheduled to construct new facilities in Mexico. To the north, GM and Honda have plans to make significant investments in Canada.

Click on the image at right to see a chart of the dollar value of automotive capital investments scheduled to begin construction this year and next in Mexico and Canada.

Click on the image at right to see a chart of the dollar value of automotive capital investments scheduled to begin construction this year and next in Mexico and Canada.

"There will be a lot of people in and out of the auto industry watching President Trump's tweets with one eye and automakers' capital investment decisions with the other," commented David Pickering, Industrial Info's vice president of research for the Industrial Manufacturing Industry. "One of the president's most powerful weapons is the bully pulpit, and Trump has shown a willingness to use that to accomplish his goals."

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and 10 international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. Follow IIR on: Facebook - Twitter - LinkedIn. For more information on our coverage, send inquiries to info@industrialinfo.com or visit us online at http://www.industrialinfo.com.

Consumers purchased a record 17.6 million new cars and trucks in 2016, slightly over the 17.5 million units that were sold in 2015, according to Autodata, which tracks vehicle sales. Analysts credited declining gas prices, hefty year-end incentives, an improving economy and low interest rates as factors behinds 2016's record sales year.

Whether 2017 unit sales will set a new record is an open question. But one thing seems clear: This year, a growing percentage of cars and trucks will be made in the U.S., if President Trump has anything to say about it.

And he has been vocal, mainly communicating his views via tweets posted to Twitter, first as a presidential candidate and then as president-elect. Trump promised to boost the U.S. economy by levying import fees on foreign-made goods, including tariffs of 35% on cars imported from Mexico.

He followed those words with deeds January 23 when he vetoed the Trans-Pacific Partnership (TPP), a trade agreement negotiated over several years with 11 other countries, including Japan, Australia, New Zealand, Mexico, Canada and other nations. Sean Spicer, the president's spokesman, said, "this executive action ushers in a new era of U.S. trade policy, in which the Trump administration will pursue bilateral trade opportunities with allies around the globe. The Trump administration wants free and fair trade throughout the world."

The next day, Tuesday, January 24, in advance of a meeting with the nation's largest carmakers, Trump tweeted, "I want new plants to be built here for cars sold here!" Then, during a meeting with the leaders of General Motors Company (NYSE:GM) (Detroit, Michigan), Ford Motor Company (NYSE:F) and Fiat Chrysler Automobiles NV (NYSE:FCAU) (London, United Kingdom), Trump told the automakers his administration will try to make it easier to build plants in the United States. He also assured them they were not the only companies and industries that were being lobbied to keep jobs in the U.S.: "You're not being singled out."

News reports after the meeting said the executives agreed to work with the new administration on items like tax, regulation, and trade policies. "There's a huge opportunity, working together as an industry," Mary Barra, chief executive at GM, said.

Some carmakers, including GM, Ford and Toyota Motor Corporation (NYSE:TM) (Toyota, Japan) were criticized by Trump in tweets for not building more vehicles in the U.S. Last week, after a critical tweet from Trump, GM agreed to invest an estimated $1 billion to create about 7,000 new jobs in the U.S. The jobs will be in manufacturing and information technology. GM denied the moves were in response to criticism from Trump.

Prior to Trump's election, GM had been aggressively investing in Mexico and laying off employees in the U.S., according to a report in the Detroit Free Press. Since late 2014, the newspaper reported, GM has announced more than $10 billion of investments and more than 5,000 new jobs in Mexico.

Trump also threatened Toyota with a "big border tax" if it went forward with its decision to build an assembly plant in Mexico to make Corollas for the U.S. market. Toyota held firm, but the tweet knocked about $2 billion off the automaker's market capitalization. A few days later, after the dust settled, Toyota said it planned to invest $10 billion over five years in the U.S., the same amount it has invested in the U.S. over the previous five years.

Carmakers also find themselves in the crosshairs when a Trump tweet is not factually accurate. Last November, for example, shortly after his election as president, Trump criticized Ford for its decision to close a Kentucky manufacturing facility and move jobs to Mexico. Ford said it never planned to close the facility, only to shift production of one model made there to Mexico. The Kentucky facility would make other models. Weeks later, Trump congratulated Ford for keeping the Kentucky plant open.

In the U.S., automakers have a total of 461 capital and maintenance projects scheduled to kick off in 2017 and 2018, with a total investment value of about $13.9 billion, according to Industrial Info's North American Project Platform. These projects include grassroot new assembly lines or component manufacturing factories, as well as expansion of existing plants. The Great Lakes region is expected to see the greatest amount of project activity, with about 229 projects worth $8.2 billion scheduled to begin construction in 2017 and 2018. The Southeast, West Coast and Mid-Atlantic regions trail the Great Lakes area for project activity over the next two years.

Click on the image at right to see a chart of U.S. regions with greatest dollar-value of project activity over the next two years.

Click on the image at right to see a chart of U.S. regions with greatest dollar-value of project activity over the next two years. Some of the biggest domestic auto-related projects scheduled to begin construction between now and the end of 2018 include:

- Tesla's $1.26-billion expansion of its Freemont, California, vehicle assembly plant, which is tentatively scheduled to begin turning dirt by mid-2017

- Lucid Motors' $700-million grassroot electric vehicle manufacturing plant, scheduled to be built in Casa Grande, Arizona. Construction of that project is scheduled to begin in mid-2017and be completed in late 2018.

- Sentry Tire Americas' grassroot tire manufacturing project in Lagrange, Georgia. This $530 million project also is scheduled to break ground in mid-2017 and be operating 13 months afterward.

Click on the image at right to see a chart of U.S. regions with greatest dollar-value of auto industry projects scheduled to begin construction in 2015 and 2016 that were cancelled or placed on hold.

Click on the image at right to see a chart of U.S. regions with greatest dollar-value of auto industry projects scheduled to begin construction in 2015 and 2016 that were cancelled or placed on hold.The vehicle manufacturing industry reportedly accounts for an estimated 20% of U.S. gross domestic product (GDP). A surge in investment in that industry may lead to more parts and cars being made domestically, but the impact on jobs may be less clear: many assembly plants rely more on robots than workers to assemble vehicles. So domestic investment could increase, and domestic production could increase, but automation on the factory floor may limit future assembly-line job growth.

Whether Trump's automobile trade policies will affect carmakers' decisions to build cars or parts factories in Mexico or Canada remains an open question. Industrial Info is tracking 218 active automotive-related capital and maintenance projects valued at $4.5 billion that are scheduled to kick off construction this year or next year in Canada or Mexico. Canada is home to 120 projects valued at $1.5 billion. Another 98 projects, valued at about $3 billion, are scheduled to be built in Mexico. Units of Volkswagen, Toyota and Mazda are scheduled to construct new facilities in Mexico. To the north, GM and Honda have plans to make significant investments in Canada.

Click on the image at right to see a chart of the dollar value of automotive capital investments scheduled to begin construction this year and next in Mexico and Canada.

Click on the image at right to see a chart of the dollar value of automotive capital investments scheduled to begin construction this year and next in Mexico and Canada. "There will be a lot of people in and out of the auto industry watching President Trump's tweets with one eye and automakers' capital investment decisions with the other," commented David Pickering, Industrial Info's vice president of research for the Industrial Manufacturing Industry. "One of the president's most powerful weapons is the bully pulpit, and Trump has shown a willingness to use that to accomplish his goals."

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and 10 international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. Follow IIR on: Facebook - Twitter - LinkedIn. For more information on our coverage, send inquiries to info@industrialinfo.com or visit us online at http://www.industrialinfo.com.