Power

EPA Strikes Again With 'New Source Performance Standard'

This week, the U.S. Environmental Protection Agency (EPA) introduced the New Source Performance Standard.

Written by Brock Ramey, Manager for North American Power Research, Industrial Info Resources (Sugar Land, Texas)--This week, the U.S. Environmental Protection Agency (EPA) introduced the New Source Performance Standard. These new emissions rules reconfirm that the agency has lost sight of what is truly going on in the country and that the Obama administration's "green initiative" has once again struck a blow to electrical generation utilities. In the New Source Performance Standard (NSPS), the EPA once again takes a swing at carbon dioxide emission levels from fossil-fueled power plants.

This week the industry got a full view the 200+ page brief that calls for the reduction of carbon dioxide emissions as part of NSPS. One of the key aspects of the regulation calls for new coal- and oil-fired assets that generate more than 25 megawatts of power and emit more than 1,000 tons of carbon dioxide emissions per Megawatt hour to be fitted with carbon capture and sequestration (CCS) technology. Operating and already under construction plants are exempt from the CCS requirement--which is good because no coal-fired power plant would be able to meet this regulation.

In essence, the NSPS requires that new coal-fired power plants are as emission-efficient as gas-fired combined-cycle power plants, prompting the question, "Why would anyone even consider constructing a new coal-fired plant?" The only type of facility that can meet these standards are natural gas-fired units. In addition, under the Clean Air Act section 111, any operational plant that makes a major modification should be up for an NSPS review. But, the new proposed EPA regulation states that operational power plants that make these major modifications are exempt from NSPS review, creating the most confusing and weird regulation of all.

The NSPS takes us back to the 2007-10 period, when carbon-capture regulations and legislation such as the Boxer Bill were flying around the capital. During that time, the industry provided data showing that carbon capture and sequestration was a largely unproven technology on a commercial scale. In addition, constructing CCS technology was extremely expensive--to the tune of approximately $3 million per megawatt--and parasitically consumed massive amounts of electrical generation from the facility in order to operate.

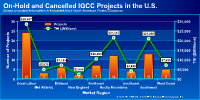

Despite these major drawbacks, the industry took a step forward and began proposing retrofits of CCS technology, as well as integrated gasification combined-cycle (IGCC) and CCS projects. When the price tag started to rise to more than $3 billion for a 400-MW IGCC project, a large number of these projects were shelved. Only a handful of IGCC projects remain active in the U.S. Duke Energy Corporation's (NYSE:DUK) Edwardsport IGCC project in Indiana was approved and constructed, but arrived millions of dollars over-budget--costs that were passed on to the ratepayers. Industrial Info is tracking 76 canceled or on-hold IGCC projects with a combined total investment value (TIV) of more than $100 billion.

Click on image at right for a breakdown by market region of U.S. IGCC projects that have been cancelled or placed on hold.

Click on image at right for a breakdown by market region of U.S. IGCC projects that have been cancelled or placed on hold.The past regulations drove the cost of conventional coal-fired generation up to the billions as well, causing numerous coal-fired projects to be looked at again and some to be scrubbed all together.

American Electric Power Company (NYSE:AEP) invested more than $75 million to construct a pilot CCS project at the company's Mountaineer plant in West Virginia but scrapped additional plans to expand the project after cost analysis. (For additional information, see July 18, 2011, article - AEP Terminates Commercial-Scale CCS Project in West Virginia.) In addition, geologists have stated that there are limited storage sites that satisfy the need for carbon storage without future studies.

Industrial Info Resources is also actively tracking almost 100 environmental retrofits that are scheduled to occur in four or five years in the U.S. with a combined TIV of more than $18 billion. This number is increasing quickly, as projects shelved since 2008 are coming back to life.

Click on image at left for a breakdown by market region of active environmental retrofit projects.

Click on image at left for a breakdown by market region of active environmental retrofit projects.In addition, Industrial Info is tracking more than 30 gigawatts of oil- and coal-fired generation scheduled that is scheduled to be retired by the end of 2016. The majority of these closures are due to the current proposed regulations. As one might expect, the EPA's estimates of coal-fired closures caused by its emissions regulations is a much lower number, and the agency counters that age and operational times of many of the plants are the primary reasons for closing.

Over the last two or three years, industry groups such as the American Coal Council, the American Power Plant Association and others have spoken out against the proposed legislation, and NSPS was no exception.

In essence, critics of the massive amounts of regulations coming from the EPA point out that the regulations will:

- result in increased electrical rates that will be passed on to the consumer.

- limit the country's sources of electrical generation opportunities and sources.

- negatively affect the already struggling U.S. economy.

- negatively affect the country's high unemployment rate.

- increase the need of governmental financial support for the renewable generation sector.

- increase the number and cost of base load generation maintenance activities.

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, and eight offices outside of North America, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities.

/news/article.jspfalse

Want More IIR News?

Make us a Preferred Source on Google to see more of us when you search.

Add Us On GoogleAsk Us

Have a question for our staff?

Submit a question and one of our experts will be happy to assist you.

Forecasts & Analytical Solutions

Where global project and asset data meets advanced analytics for smarter market sizing and forecasting.

Learn MoreRelated Articles

Industrial Project Opportunity Database and Project Leads

Get access to verified capital and maintenance project leads to power your growth.

Learn MoreIndustry Intel

-

From Data to Decisions: How IIR Energy Helps Navigate Market VolatilityOn-Demand Podcast / Nov. 18, 2025

-

Navigating the Hydrogen Horizon: Trends in Blue and Green EnergyOn-Demand Podcast / Nov. 3, 2025

-

ESG Trends & Challenges in Latin AmericaOn-Demand Podcast / Nov. 3, 2025

-

2025 European Transportation & Biofuels Spending OutlookOn-Demand Podcast / Oct. 27, 2025

-

2025 Global Oil & Gas Project Spending OutlookOn-Demand Podcast / Oct. 24, 2025