Reports related to this article:

Project(s): View 4 related projects in PECWeb

Plant(s): View 2 related plants in PECWeb

Released January 06, 2014 | SUGAR LAND

en

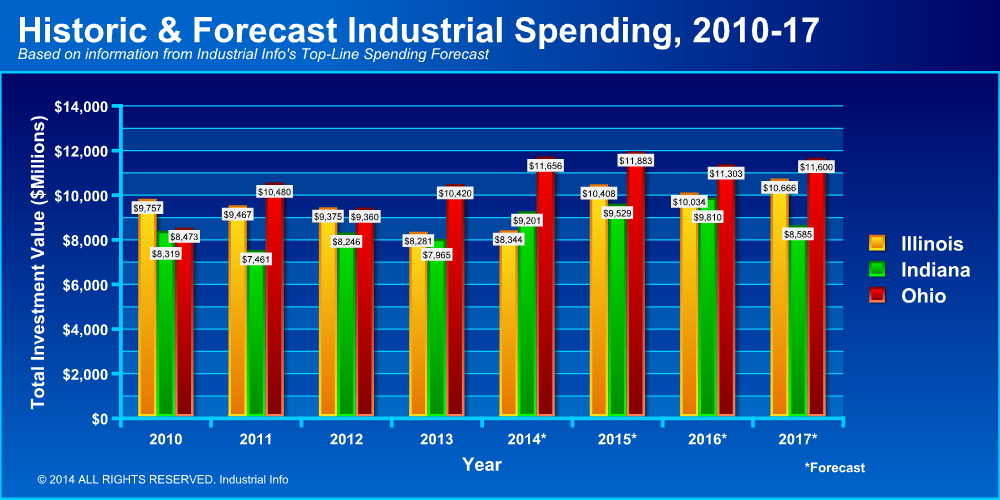

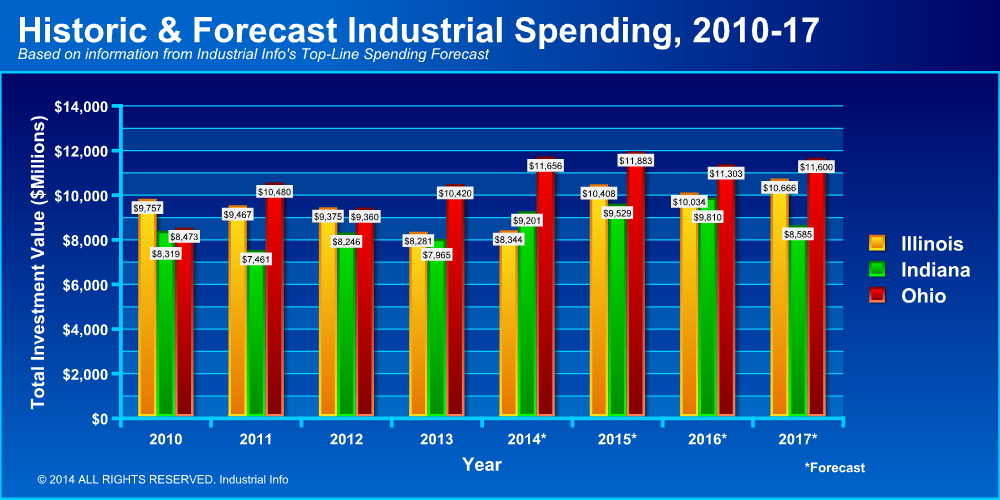

Researched by Industrial Info Resources (Sugar Land, Texas)--As multiple large industrial projects are set to be under construction simultaneously in the Great Lakes region over the next few years, the area's demand for skilled craft labor is expected to steadily increase between now and 2016. Industrial Info forecasts that labor demand for eight skilled crafts, including welders, pipefitters, electricians and boilermakers, will rise by almost 5 million man-hours between 2013 and 2016 in the region.

After peaking at approximately 28.17 million hours in 2011, skilled craft labor demand in the Great Lakes region has been declining, reaching a trough in 2013 of 21.9 million hours. However, this is set to change. Industrial Info's most recent update of the Great Lakes Region Labor Assessment Annual Subscription forecasts that regional labor demand will climb to 26.8 million man-hours by 2016 and remain above 26 million hours through 2017.

While Industrial Info tracks clear shortages or surpluses in certain crafts, it also is tracking percent utilization rates that indicate retention and productivity in certain crafts that are utilizing high levels of local craftsmen. These utilization rates are on track to be substantial within certain metropolitan areas.

Labor activity in many of the areas surrounding the Great Lakes will change as project activity shifts, but the largest concentrated rise in demand, which will certainly have an effect on wages and availability throughout the region, will occur in the area around Toledo, Ohio. Craft labor demand here is expected to more than triple between 2013 and 2016. In this area in 2014, Industrial Info is forecasting an 85% labor utilization rate for boilermakers that could lead to poor retention, higher retention bonuses, and lesser productivity. Industrial Info also expects tight demand in the area for instrumentation techs in the area this year, while the utilization rate for electricians and welders is forecast to be about 60% each.

Labor activity in many of the areas surrounding the Great Lakes will change as project activity shifts, but the largest concentrated rise in demand, which will certainly have an effect on wages and availability throughout the region, will occur in the area around Toledo, Ohio. Craft labor demand here is expected to more than triple between 2013 and 2016. In this area in 2014, Industrial Info is forecasting an 85% labor utilization rate for boilermakers that could lead to poor retention, higher retention bonuses, and lesser productivity. Industrial Info also expects tight demand in the area for instrumentation techs in the area this year, while the utilization rate for electricians and welders is forecast to be about 60% each.

The overall increase in labor use in the Toledo area is primarily due to Husky Energy's (NYSE:HSE) upgrade and unit addition projects at its refinery in Lima, Ohio, as well as similar projects at its Toledo Refinery, which it owns jointly with BP plc (NYSE:BP). The projects are designed to increase the refineries' crude slates to process heavy Canadian crude and a have a combined total investment value (TIV) of more than $5 billion. Various pieces of the projects are set to kick off from 2015 onward, with overall completion slated for 2017. These projects are causing labor demand in the Toledo area to increase from 3.15 million hours in 2013 to 9.78 million in 2015, remaining above 9.4 million hours in 2016 before the projects begin winding down. Some of the strongest demand growth in the area between 2013 and 2017 is for electricians and welders.

Outside of the Refining Industry, the Power Industry is a mainstay of regional spending. Power producers in the Great Lakes and Midwest areas have been particularly affected by increasing government regulations for power plant emissions, resulting in the retirement of aging coal-fired units, the construction of natural gas, hydro and wind-powered plants, and the installation of emissions-control equipment at existing coal-fired plants.

In southernmost Indiana, several emissions-control projects are set to kick off in the next few years. These projects, coupled with $2.8 billion of fertilizer projects that are planned to kick off in 2014, are set to drive up craft labor demand in the area from about 2 million hours in 2013 to about 4.8 million hours in 2015, when construction activity peaks--a 140% increase. In 2014 and 2015, in the Evansville, Indiana, metropolitan area, Industrial Info is forecasting shortages of crane and tower operators, which will have a utilization rate of more than 90%.

As the U.S. industrial landscape continues to change dramatically, labor populations continue to shift, and areas of significant project growth continue to compete with one another to draw these in-demand skilled craft workers.

The areas with high populations of skilled workers represent significant recruitment areas for craft labor for major upcoming industrial projects across the country, and craftsmen in these areas could be pulled away in response to higher wages and increased benefits offered elsewhere.

Industrial Info's Great Lakes Region Labor Assessment Annual Subscription, which includes tracking of wage and per diem rates and labor utilization figures, is a subscription-based product that is updated quarterly, designed to provide recruiters and employment executives insight into where the highest and lowest craft labor populations exist, and the percentage rates of historical and forecast growth and contraction. To learn more about this product and the shifting labor market, contact Tony Salemme, vice president of Industrial Info's Craft Labor Group, at tsalemme@industrialinfo.com or by calling (209) 547-9878.

View Project Report - 300106893 300143471 300096791 300096834

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, three offices in North America and nine international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities.

After peaking at approximately 28.17 million hours in 2011, skilled craft labor demand in the Great Lakes region has been declining, reaching a trough in 2013 of 21.9 million hours. However, this is set to change. Industrial Info's most recent update of the Great Lakes Region Labor Assessment Annual Subscription forecasts that regional labor demand will climb to 26.8 million man-hours by 2016 and remain above 26 million hours through 2017.

While Industrial Info tracks clear shortages or surpluses in certain crafts, it also is tracking percent utilization rates that indicate retention and productivity in certain crafts that are utilizing high levels of local craftsmen. These utilization rates are on track to be substantial within certain metropolitan areas.

Labor activity in many of the areas surrounding the Great Lakes will change as project activity shifts, but the largest concentrated rise in demand, which will certainly have an effect on wages and availability throughout the region, will occur in the area around Toledo, Ohio. Craft labor demand here is expected to more than triple between 2013 and 2016. In this area in 2014, Industrial Info is forecasting an 85% labor utilization rate for boilermakers that could lead to poor retention, higher retention bonuses, and lesser productivity. Industrial Info also expects tight demand in the area for instrumentation techs in the area this year, while the utilization rate for electricians and welders is forecast to be about 60% each.

Labor activity in many of the areas surrounding the Great Lakes will change as project activity shifts, but the largest concentrated rise in demand, which will certainly have an effect on wages and availability throughout the region, will occur in the area around Toledo, Ohio. Craft labor demand here is expected to more than triple between 2013 and 2016. In this area in 2014, Industrial Info is forecasting an 85% labor utilization rate for boilermakers that could lead to poor retention, higher retention bonuses, and lesser productivity. Industrial Info also expects tight demand in the area for instrumentation techs in the area this year, while the utilization rate for electricians and welders is forecast to be about 60% each.The overall increase in labor use in the Toledo area is primarily due to Husky Energy's (NYSE:HSE) upgrade and unit addition projects at its refinery in Lima, Ohio, as well as similar projects at its Toledo Refinery, which it owns jointly with BP plc (NYSE:BP). The projects are designed to increase the refineries' crude slates to process heavy Canadian crude and a have a combined total investment value (TIV) of more than $5 billion. Various pieces of the projects are set to kick off from 2015 onward, with overall completion slated for 2017. These projects are causing labor demand in the Toledo area to increase from 3.15 million hours in 2013 to 9.78 million in 2015, remaining above 9.4 million hours in 2016 before the projects begin winding down. Some of the strongest demand growth in the area between 2013 and 2017 is for electricians and welders.

Outside of the Refining Industry, the Power Industry is a mainstay of regional spending. Power producers in the Great Lakes and Midwest areas have been particularly affected by increasing government regulations for power plant emissions, resulting in the retirement of aging coal-fired units, the construction of natural gas, hydro and wind-powered plants, and the installation of emissions-control equipment at existing coal-fired plants.

In southernmost Indiana, several emissions-control projects are set to kick off in the next few years. These projects, coupled with $2.8 billion of fertilizer projects that are planned to kick off in 2014, are set to drive up craft labor demand in the area from about 2 million hours in 2013 to about 4.8 million hours in 2015, when construction activity peaks--a 140% increase. In 2014 and 2015, in the Evansville, Indiana, metropolitan area, Industrial Info is forecasting shortages of crane and tower operators, which will have a utilization rate of more than 90%.

As the U.S. industrial landscape continues to change dramatically, labor populations continue to shift, and areas of significant project growth continue to compete with one another to draw these in-demand skilled craft workers.

The areas with high populations of skilled workers represent significant recruitment areas for craft labor for major upcoming industrial projects across the country, and craftsmen in these areas could be pulled away in response to higher wages and increased benefits offered elsewhere.

Industrial Info's Great Lakes Region Labor Assessment Annual Subscription, which includes tracking of wage and per diem rates and labor utilization figures, is a subscription-based product that is updated quarterly, designed to provide recruiters and employment executives insight into where the highest and lowest craft labor populations exist, and the percentage rates of historical and forecast growth and contraction. To learn more about this product and the shifting labor market, contact Tony Salemme, vice president of Industrial Info's Craft Labor Group, at tsalemme@industrialinfo.com or by calling (209) 547-9878.

View Project Report - 300106893 300143471 300096791 300096834

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, three offices in North America and nine international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities.