Production

Ethane Exports Mean Big Business in U.S.

Since the shale gas revolution, U.S. exports of ethane and other natural gas liquids (NGLs) have continued to increase.

Released Tuesday, September 06, 2016

Reports related to this article:

Project(s): View 5 related projects in PECWeb

Plant(s): View 3 related plants in PECWeb

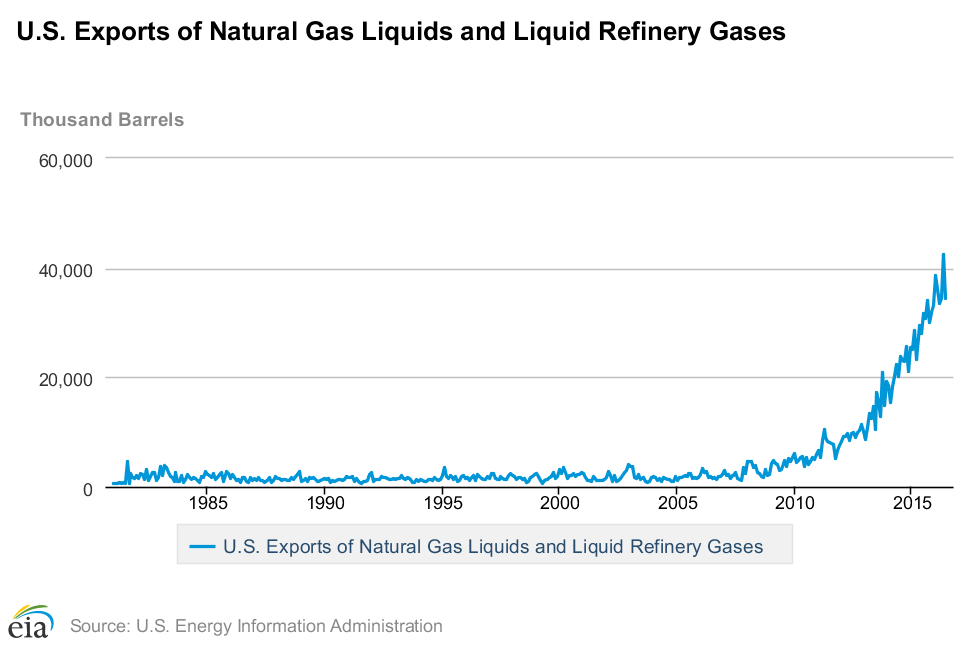

Researched by Industrial Info Resources (Sugar Land, Texas)--Since the shale gas revolution, U.S. exports of ethane and other natural gas liquids (NGLs) have continued to increase. The U.S. Energy Information Administration shows that in 2008, monthly exports of natural gas liquids and liquid refinery gases did not exceed 5 million barrels during the entire year, while in June 2016 (the latest month for which the EIA has collected data), U.S. NGL and liquid refinery gas exports topped 34 million barrels for the month, and were more than 42 million barrels in the prior month.

Click on image at right for a graph showing U.S. exports natural gas liquids and liquid refinery gases. Courtesy of U.S. Energy Information Administration.

Click on image at right for a graph showing U.S. exports natural gas liquids and liquid refinery gases. Courtesy of U.S. Energy Information Administration.The increased exports come because of a tremendous uptick in natural gas and NGL production in the U.S., and as much as U.S. producers are interested in unloading the gas, the interest is reciprocal--foreign nations are interested in the cheap and plentiful NGLs on offer from the U.S.

While the U.S. has seen a dramatic increase in the number of grassroot ethane-based ethylene crackers being constructed in response to the inexpensive ethane feedstock, other companies abroad are actually investing in converting more expensive naphtha-based crackers to use ethane.

An example of this includes SABIC UK Petrochemicals' (Redcar, England) construction of an ethane storage unit and conversion of a naphtha-based ethylene cracker to run from ethane. Construction of the $185 million+ storage facility kicked off in 2015 and is expected to be completed in the near future. Conversion of the first eight out of 17 furnaces in the cracker are currently being converted to run on ethane imported from the U.S., and this initial project is planned for completion by the end of the year. Conversion of the remaining nine furnaces is set to kick off in 2017, with completion in 2018. The combined conversion projects have an estimated total investment value of in excess of $265 million.

"The expectation that the U.S. will remain in a net long position for inexpensive NGLs well into the future will only continue to drive naphtha to ethane conversions across Europe and Asia," says Trey Hamblet, Industrial Info's vice president of global research for the Chemical Processing Industry. "This outlook will also continue to support additional investments for new ethylene capacity domestically."

Ethane and NGL export facilities are also springing up in the U.S. Last week, Enterprise Products Partners (NYSE:EPD) (Houston, Texas) launched its first ethane cargo from its new facility in Morgan's Point, Texas, along the Gulf Coast. Construction of the terminal commenced in late 2014 at a cost of approximately $800 million. The INEOS Intrepid set sail from the Morgan's Point facility on Thursday, loaded with approximately 265,000 barrels of ethane, bound for chemical manufacturer Ineos' (Rolle, Switzerland) facility in Rafnes, Norway. The Intrepid is one of eight liquefied petroleum gas (LPG) tankers built by Ineos to deliver cheap shale gas from the U.S. to Europe.

Earlier this year, in March, the first shipment of Marcellus Shale ethane set sail from Sunoco Logistics Partners' (NYSE:SXL) (Newtown Square, Pennsylvania) terminal in Marcus Hook, Pennsylvania. The ethane was delivered to the facility via Sunoco's Mariner East NGL pipeline, which the company spent hundreds of millions of dollars in constructing. As U.S. production of ethane continues to outweigh domestic demand, Sunoco is in the process of constructing a Phase II expansion of the pipeline to deliver even more NGLs to the facility. As long as ethane and other NGLs remain plentiful in the U.S., export markets will continue to open up.

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and 10 international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. Follow IIR on: Facebook - Twitter - LinkedIn. For more information on our coverage, send inquiries to info@industrialinfo.com or visit us online at http://www.industrialinfo.com.

/news/article.jsp

false

Want More IIR News?

Make us a Preferred Source on Google to see more of us when you search.

Add Us On GoogleAsk Us

Have a question for our staff?

Submit a question and one of our experts will be happy to assist you.

Forecasts & Analytical Solutions

Where global project and asset data meets advanced analytics for smarter market sizing and forecasting.

Learn MoreRelated Articles

-

Energy Transfer Benefits from Record U.S. Oil, Gas Productio...February 22, 2019

-

Energy Transfer's Mariner East 2 NGLs Pipeline Begins Servic...January 02, 2019

-

Williams Files With FERC for Full Operation of Atlantic Sunr...August 30, 2018

-

Energy Transfer Partners' Major Projects Approach Completion...August 10, 2018

Industrial Project Opportunity Database and Project Leads

Get access to verified capital and maintenance project leads to power your growth.

Learn MoreIndustry Intel

-

From Data to Decisions: How IIR Energy Helps Navigate Market VolatilityOn-Demand Podcast / Nov. 18, 2025

-

Navigating the Hydrogen Horizon: Trends in Blue and Green EnergyOn-Demand Podcast / Nov. 3, 2025

-

ESG Trends & Challenges in Latin AmericaOn-Demand Podcast / Nov. 3, 2025

-

2025 European Transportation & Biofuels Spending OutlookOn-Demand Podcast / Oct. 27, 2025

-

2025 Global Oil & Gas Project Spending OutlookOn-Demand Podcast / Oct. 24, 2025