Power

Gas-Fired Power Development Expected to Surge Across North America

The 'dash to gas' has shifted from a sprint to a marathon. Tougher environmental regulation and inexpensive, abundant natural gas supplies are expected to drive increased construction of gas-fired Power projects across North America for the next few years.

Released Monday, February 13, 2017

Reports related to this article:

Project(s): View 8 related projects in PECWeb

Plant(s): View 8 related plants in PECWeb

Written by John Egan for Industrial Info Resources (Sugar Land, Texas)--The "dash to gas" has shifted from a sprint to a marathon. Tougher environmental regulation and inexpensive, abundant natural gas supplies are expected to drive increased construction of gas-fired Power projects across North America for the next few years, Britt Burt, Industrial Info's vice president of research for the Global Power Industry, told over 1,000 attendees at the 2017 Market Outlook event held last month in Houston.

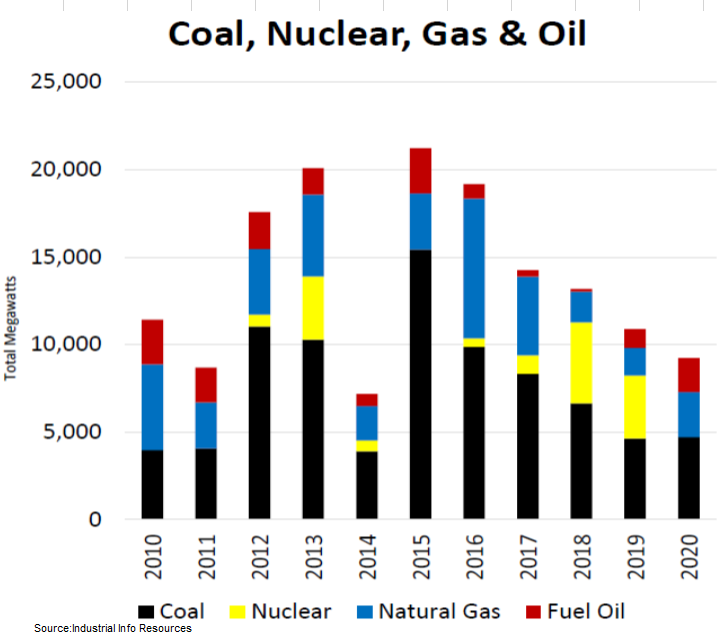

In the U.S., approximately 25,000 megawatts (MW) of coal-fired generation are scheduled to close between 2017 and 2020, Burt told Outlook attendees January 17. Those scheduled closures follow the retirement of roughly 25,000 MW of coal-fired generation in 2015 and 2016, he added. "The U.S. generating fleet totals about 300,000 MW, so removing nearly 50,000 megawatts of coal generation from that fleet will have consequences for a long period of time."

Click on the image at right for a graphic of scheduled power plant closures, by fuel type, from 2010 to 2020.

Click on the image at right for a graphic of scheduled power plant closures, by fuel type, from 2010 to 2020. Burt told attendees gas-fired power development is expected to surge in the coming years across North America. "North American has a full pipeline of gas-fired power generation projects scheduled to kick off between 2017 and 2020," he told the event's attendees. The value of these projects is about $84 billion.

"We don't believe all of those projects will begin construction according to schedule, but we have a higher confidence in gas-fired power projects than we do in other types of generation projects," he added. "We think there is a high probability that 149 of these gas-fired power projects, valued at about $51 billion, will begin breaking ground across North America according to their schedules."

The new Trump administration already took steps that could indirectly benefit natural gas power development. In one of his first executive orders, the president established a process to determine whether infrastructure projects like pipelines and electric transmission projects were to be considered "high priority." Those projects would be expedited by his administration. For more on that, see January 31, 2017, article - Trump Orders Benefit KXL, DAPL and Other 'High Priority' Infrastructure Projects.

That order did not mention expediting siting and construction of new power plants. But the explicit mention of pipelines and transmission projects, which are needed to fuel gas-fired generators and transmit their electric output, could indirectly benefit gas-power developers by getting those infrastructure projects built faster, which could quicken power plant development. As a candidate, Trump vowed, "Under my presidency, we will accomplish complete American energy independence. ... We will get the bureaucracy out of the way of innovation, so we can pursue all forms of energy."

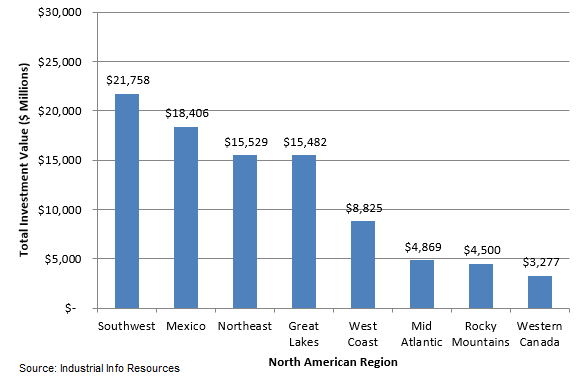

Across North America, four regions stand out for their high level of gas-fired power development: the southwestern U.S., Mexico, the northeastern U.S. and the Great Lakes region.

Click on the image at right to see a graphic of the North American regions with the highest value of gas-fired power development scheduled to kick off construction between 2017 and 2020.

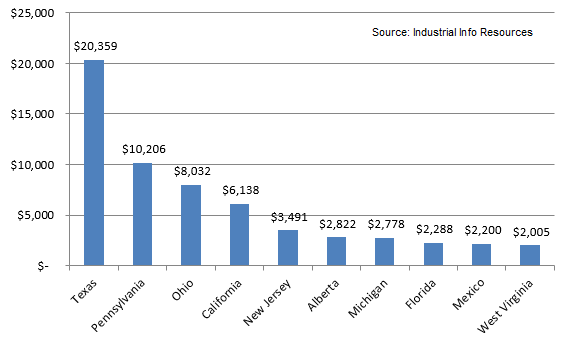

Click on the image at right to see a graphic of the North American regions with the highest value of gas-fired power development scheduled to kick off construction between 2017 and 2020.On a state-by-state basis, Texas, Pennsylvania, Ohio, California and New Jersey have the largest dollar value of gas-fired power projects scheduled to break ground between 2017 and 2020.

Click on the image at right to see the 10 North American states and provinces where gas-fired power development is most active.

Click on the image at right to see the 10 North American states and provinces where gas-fired power development is most active.Burt told the Outlook attendees that not every megawatt of generating capacity that is scheduled to be retired will need to be replaced. Energy efficiency measures are holding down electric load growth. For the generation that is being built, state and federal policies offer significant financial incentives for renewable generation.

Still, North American power developers are expected to bring about 14,842 MW of new gas-fired generation online this year, well above the 8,757 MW they brought online in 2016 and the 6,728 MW of gas-fueled generation that began operating in 2015, he added. In 2017, natural gas will fuel roughly half of all the new-build generation.

Turning to construction starts this year, developers are expected to break ground on about 14,411 MW of gas-fired generation, slightly more than wind generation and more than double the amount of solar generation projects, Burt projected.

"Natural gas will be the dominant fuel for new-build generation between now and 2020," Burt said. "The future generation mix will be defined by natural gas prices and electric demand growth." For more on the overall outlook for the North American Power Industry, see January 20, 2017, article - Industrial Market Outlook in Review: Transition of U.S. Power Industry in Full Swing.

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and 10 international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. Follow IIR on: Facebook - Twitter - LinkedIn. For more information on our coverage, send inquiries to info@industrialinfo.com or visit us online at http://www.industrialinfo.com.

/news/article.jsp

false

Want More IIR News?

Make us a Preferred Source on Google to see more of us when you search.

Add Us On GoogleAsk Us

Have a question for our staff?

Submit a question and one of our experts will be happy to assist you.

Forecasts & Analytical Solutions

Where global project and asset data meets advanced analytics for smarter market sizing and forecasting.

Learn MoreRelated Articles

-

U.S. Gas-Fired Power Plants Prep for Maintenance OutagesDecember 04, 2025

-

CPS, AEP Join Buying Bonanza for U.S. Natural Gas-Fired Plan...September 19, 2025

-

U.S. Industrial Gas Market Adds More 'Green' to its MenuSeptember 27, 2023

Industrial Project Opportunity Database and Project Leads

Get access to verified capital and maintenance project leads to power your growth.

Learn MoreIndustry Intel

-

From Data to Decisions: How IIR Energy Helps Navigate Market VolatilityOn-Demand Podcast / Nov. 18, 2025

-

Navigating the Hydrogen Horizon: Trends in Blue and Green EnergyOn-Demand Podcast / Nov. 3, 2025

-

ESG Trends & Challenges in Latin AmericaOn-Demand Podcast / Nov. 3, 2025

-

2025 European Transportation & Biofuels Spending OutlookOn-Demand Podcast / Oct. 27, 2025

-

2025 Global Oil & Gas Project Spending OutlookOn-Demand Podcast / Oct. 24, 2025