Released September 24, 2015 | SUGAR LAND

en

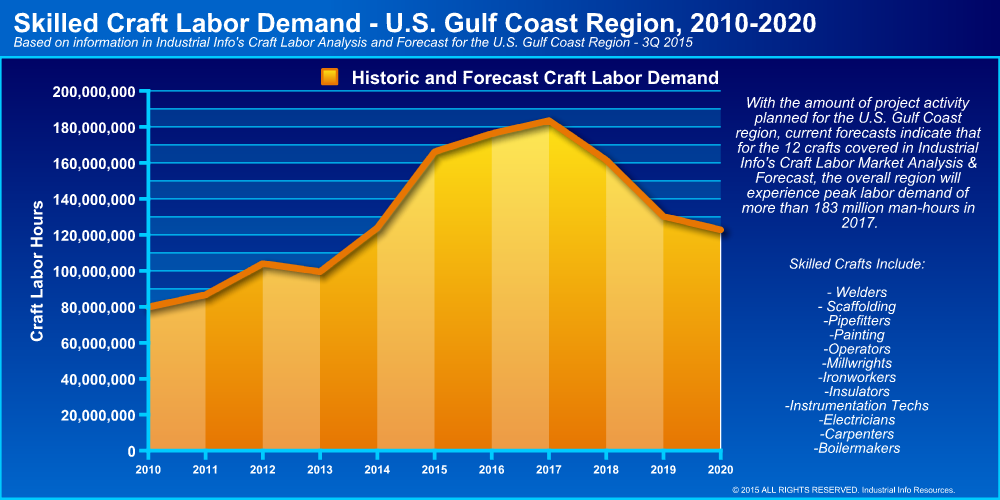

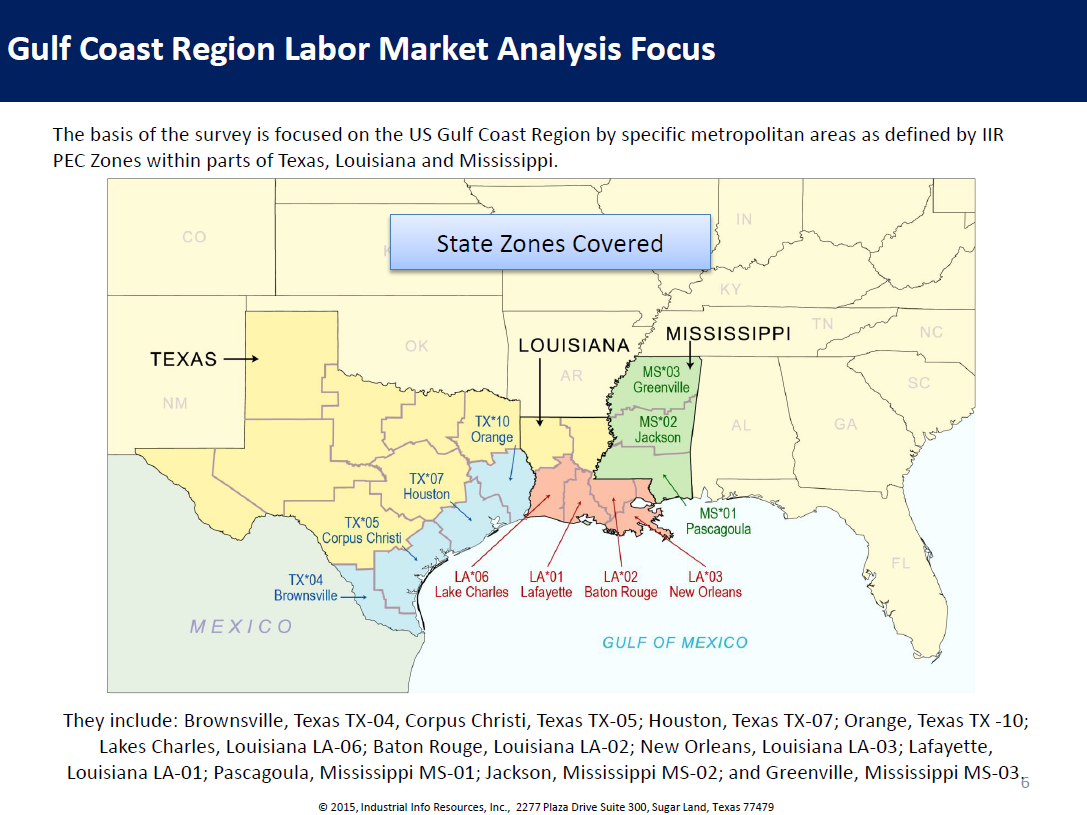

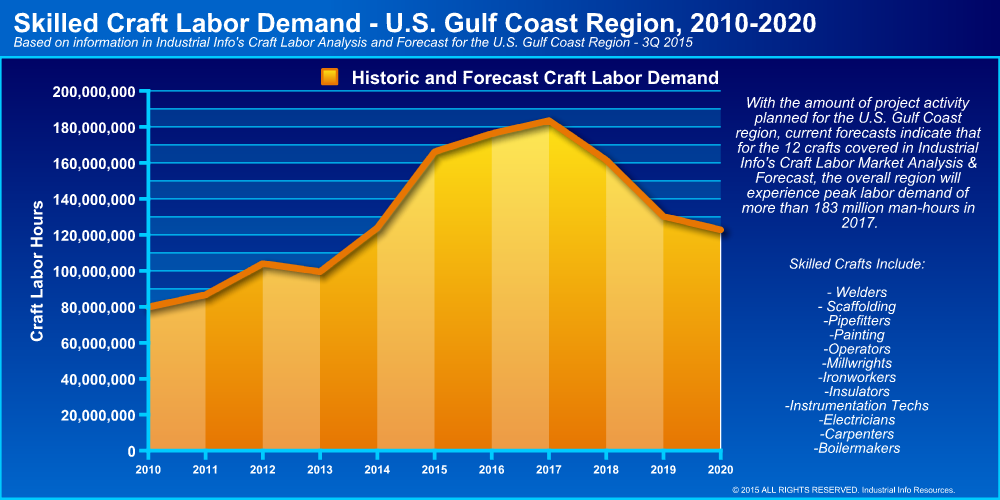

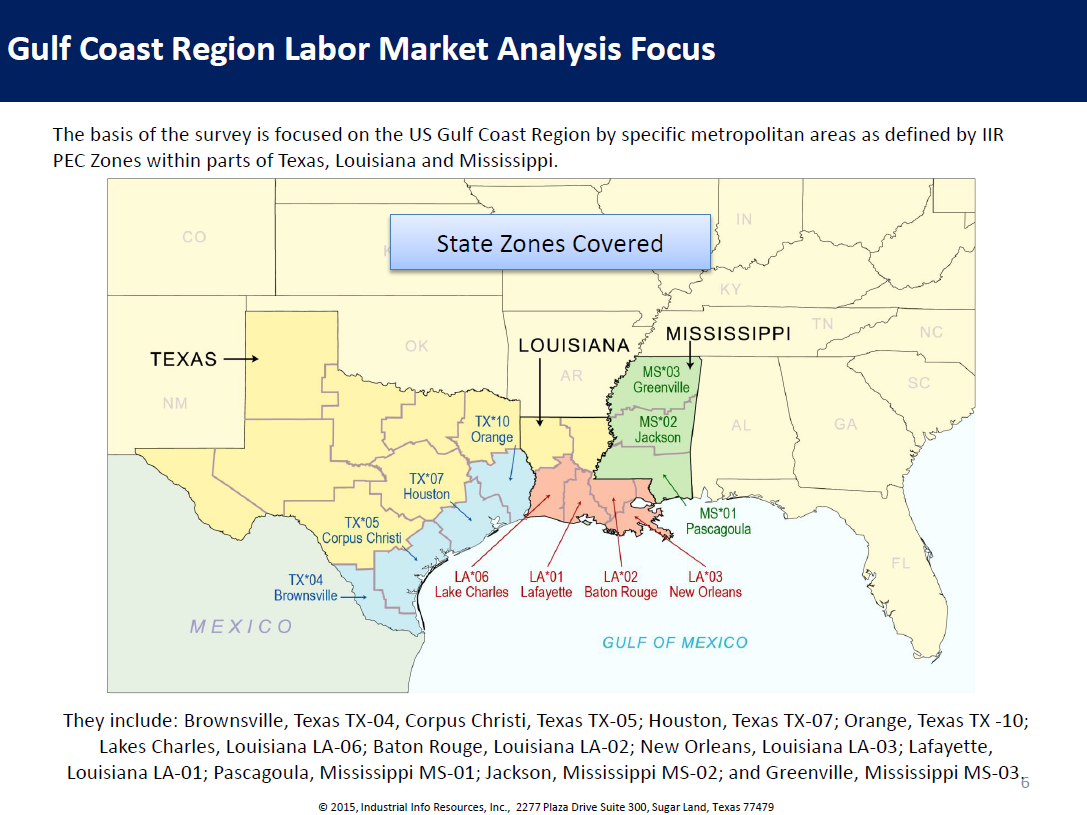

Researched by Industrial Info Resources (Sugar Land, Texas)-Industrial Info's most recent quarterly update to its Gulf Coast Labor Supply, Demand & Wage Rate Analysis continues to demonstrate that the U.S. Gulf Coast is the hottest region in the country for industrial project activity. The Gulf Coast region between Brownsville, Texas, and Pascagoula, Mississippi, has the largest concentration of future spending of anywhere in the country. Over the next five years, an estimated $284.3 billion will be spent in this region, compared to only $158.2 billion in spending from 2010 through 2014. Labor demand in the region has consistently increased since 2013 and is forecast to reach a peak of 183.5 million hours in 2017, representing growth of approximately 84% from 2013 levels.

Along with labor demand, peak project spending in the U.S. Gulf Coast region is also forecast to occur in 2017 and is estimated to be $64.1 billion that year, up from the previous forecast of $62.9 billion. Tony Salemme, vice president of Industrial Info's Craft Labor Group, explains: "Part of what we're seeing here is the effect of low natural gas prices on planned industrial project activity in the region. Year-to-date project fallout is higher than last year, but we're actually seeing very few cancellations or projects being placed on hold. What we are seeing is an increasing number of projects being pushed out to a later date, which is increasing planned spending and project activity in 2016 and 2017."

Along with labor demand, peak project spending in the U.S. Gulf Coast region is also forecast to occur in 2017 and is estimated to be $64.1 billion that year, up from the previous forecast of $62.9 billion. Tony Salemme, vice president of Industrial Info's Craft Labor Group, explains: "Part of what we're seeing here is the effect of low natural gas prices on planned industrial project activity in the region. Year-to-date project fallout is higher than last year, but we're actually seeing very few cancellations or projects being placed on hold. What we are seeing is an increasing number of projects being pushed out to a later date, which is increasing planned spending and project activity in 2016 and 2017."

Salemme points out that regardless of where the crude oil price currently sits, the low price of natural gas feedstock for a variety of chemical projects is driving the increased spending. In addition, oil and gas production continues to be a strong driver of project activity. Over the past six years, Industrial Info has tracked more than 1,800 executed projects for pipelines, terminals and midstream oil and gas processing facilities.

Nevertheless, the fall in crude prices has definitely started affecting the development of some of the region's largest projects: LNG liquefaction and export facilities. "Global LNG prices are linked to crude oil pricing, and as landed LNG spot prices continue to tumble in key markets, increasing scrutiny is being applied to the current raft of proposed projects," says Salemme. "To account for this, Industrial Info applies a probability factor to these projects and accounts for only those with at least a 70% probability of moving ahead in our data analysis."

Interestingly, although on a cumulative basis labor in the Gulf Coast Region is set to peak in 2017, only two of the 11 metropolitan areas between Brownsville and Pascagoula show individual labor demand peaks that year. These zones are the Lake Charles and Baton Rouge metropolitan areas. Lake Charles, in particular, remains one of the busiest areas in the Gulf Coast region, with a forecast labor demand of more than 44.5 million craft labor hours in 2017, representing an increase of almost 13 million man-hours from 2015. Other areas, including Greater Houston and Corpus Christi, are forecast to experience peak labor demand in 2016. As labor demand in these areas ebbs after 2017, other key markets such as the Beaumont/Port Arthur area, Brownsville and Pascagoula are expected to begin ramping up spending, drawing on available resources throughout the region and experiencing peak construction periods in 2018, 2019 and 2020.

Interestingly, although on a cumulative basis labor in the Gulf Coast Region is set to peak in 2017, only two of the 11 metropolitan areas between Brownsville and Pascagoula show individual labor demand peaks that year. These zones are the Lake Charles and Baton Rouge metropolitan areas. Lake Charles, in particular, remains one of the busiest areas in the Gulf Coast region, with a forecast labor demand of more than 44.5 million craft labor hours in 2017, representing an increase of almost 13 million man-hours from 2015. Other areas, including Greater Houston and Corpus Christi, are forecast to experience peak labor demand in 2016. As labor demand in these areas ebbs after 2017, other key markets such as the Beaumont/Port Arthur area, Brownsville and Pascagoula are expected to begin ramping up spending, drawing on available resources throughout the region and experiencing peak construction periods in 2018, 2019 and 2020.

Industrial Info's Gulf Coast Craft Labor Market Analysis uses information taken directly from Industrial Info's database of thousands of past, present and future capital and maintenance projects. This unique, "on-the-ground" project information allows us to forecast which crafts will experience demand growth or contraction in the coming years for each of the 11 regions covered. For example, while in Houston demand for machine operators and welders is expected to show some of the strongest growth in 2016, down the road in Corpus Christi, demand for pipefitters will experience the strongest increase in demand.

Information regarding wages and capital and maintenance spending reaches back to 2012 and is forecast out to 2020, based on Industrial Info's extensive research into plant and project activity, and wage rates for 12 skilled craft trades. Industrial Info quantifies the risks for each metropolitan area by year, and tracks and forecasts wage rate movement. The estimated deficits and surpluses by craft for each metropolitan area are reported for future years.

In addition to the Gulf Coast, Industrial Info has built Labor Analysis and Forecast solutions for the Great Lakes region, Ontario, the Upper Midwest & Rockies, Pennsylvania and more.

For additional information, please call or email Tony Salemme, vice president of Industrial Info's Craft Labor Group, at (209) 547-9878 or tsalemme@industrialinfo.com.

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and ten international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities.

Along with labor demand, peak project spending in the U.S. Gulf Coast region is also forecast to occur in 2017 and is estimated to be $64.1 billion that year, up from the previous forecast of $62.9 billion. Tony Salemme, vice president of Industrial Info's Craft Labor Group, explains: "Part of what we're seeing here is the effect of low natural gas prices on planned industrial project activity in the region. Year-to-date project fallout is higher than last year, but we're actually seeing very few cancellations or projects being placed on hold. What we are seeing is an increasing number of projects being pushed out to a later date, which is increasing planned spending and project activity in 2016 and 2017."

Along with labor demand, peak project spending in the U.S. Gulf Coast region is also forecast to occur in 2017 and is estimated to be $64.1 billion that year, up from the previous forecast of $62.9 billion. Tony Salemme, vice president of Industrial Info's Craft Labor Group, explains: "Part of what we're seeing here is the effect of low natural gas prices on planned industrial project activity in the region. Year-to-date project fallout is higher than last year, but we're actually seeing very few cancellations or projects being placed on hold. What we are seeing is an increasing number of projects being pushed out to a later date, which is increasing planned spending and project activity in 2016 and 2017."Salemme points out that regardless of where the crude oil price currently sits, the low price of natural gas feedstock for a variety of chemical projects is driving the increased spending. In addition, oil and gas production continues to be a strong driver of project activity. Over the past six years, Industrial Info has tracked more than 1,800 executed projects for pipelines, terminals and midstream oil and gas processing facilities.

Nevertheless, the fall in crude prices has definitely started affecting the development of some of the region's largest projects: LNG liquefaction and export facilities. "Global LNG prices are linked to crude oil pricing, and as landed LNG spot prices continue to tumble in key markets, increasing scrutiny is being applied to the current raft of proposed projects," says Salemme. "To account for this, Industrial Info applies a probability factor to these projects and accounts for only those with at least a 70% probability of moving ahead in our data analysis."

Interestingly, although on a cumulative basis labor in the Gulf Coast Region is set to peak in 2017, only two of the 11 metropolitan areas between Brownsville and Pascagoula show individual labor demand peaks that year. These zones are the Lake Charles and Baton Rouge metropolitan areas. Lake Charles, in particular, remains one of the busiest areas in the Gulf Coast region, with a forecast labor demand of more than 44.5 million craft labor hours in 2017, representing an increase of almost 13 million man-hours from 2015. Other areas, including Greater Houston and Corpus Christi, are forecast to experience peak labor demand in 2016. As labor demand in these areas ebbs after 2017, other key markets such as the Beaumont/Port Arthur area, Brownsville and Pascagoula are expected to begin ramping up spending, drawing on available resources throughout the region and experiencing peak construction periods in 2018, 2019 and 2020.

Interestingly, although on a cumulative basis labor in the Gulf Coast Region is set to peak in 2017, only two of the 11 metropolitan areas between Brownsville and Pascagoula show individual labor demand peaks that year. These zones are the Lake Charles and Baton Rouge metropolitan areas. Lake Charles, in particular, remains one of the busiest areas in the Gulf Coast region, with a forecast labor demand of more than 44.5 million craft labor hours in 2017, representing an increase of almost 13 million man-hours from 2015. Other areas, including Greater Houston and Corpus Christi, are forecast to experience peak labor demand in 2016. As labor demand in these areas ebbs after 2017, other key markets such as the Beaumont/Port Arthur area, Brownsville and Pascagoula are expected to begin ramping up spending, drawing on available resources throughout the region and experiencing peak construction periods in 2018, 2019 and 2020.Industrial Info's Gulf Coast Craft Labor Market Analysis uses information taken directly from Industrial Info's database of thousands of past, present and future capital and maintenance projects. This unique, "on-the-ground" project information allows us to forecast which crafts will experience demand growth or contraction in the coming years for each of the 11 regions covered. For example, while in Houston demand for machine operators and welders is expected to show some of the strongest growth in 2016, down the road in Corpus Christi, demand for pipefitters will experience the strongest increase in demand.

Information regarding wages and capital and maintenance spending reaches back to 2012 and is forecast out to 2020, based on Industrial Info's extensive research into plant and project activity, and wage rates for 12 skilled craft trades. Industrial Info quantifies the risks for each metropolitan area by year, and tracks and forecasts wage rate movement. The estimated deficits and surpluses by craft for each metropolitan area are reported for future years.

In addition to the Gulf Coast, Industrial Info has built Labor Analysis and Forecast solutions for the Great Lakes region, Ontario, the Upper Midwest & Rockies, Pennsylvania and more.

For additional information, please call or email Tony Salemme, vice president of Industrial Info's Craft Labor Group, at (209) 547-9878 or tsalemme@industrialinfo.com.

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and ten international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities.