Reports related to this article:

Project(s): View 3 related projects in PECWeb

Released January 11, 2017 | SUGAR LAND

en

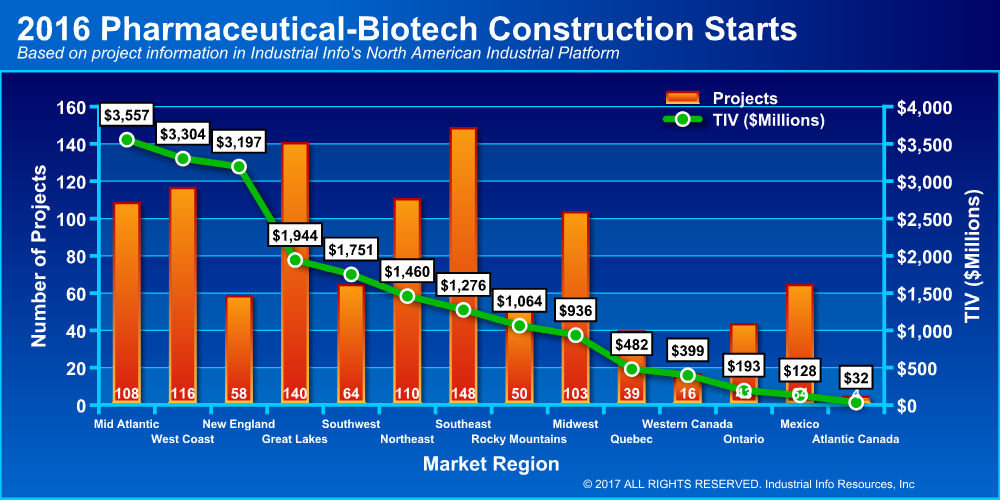

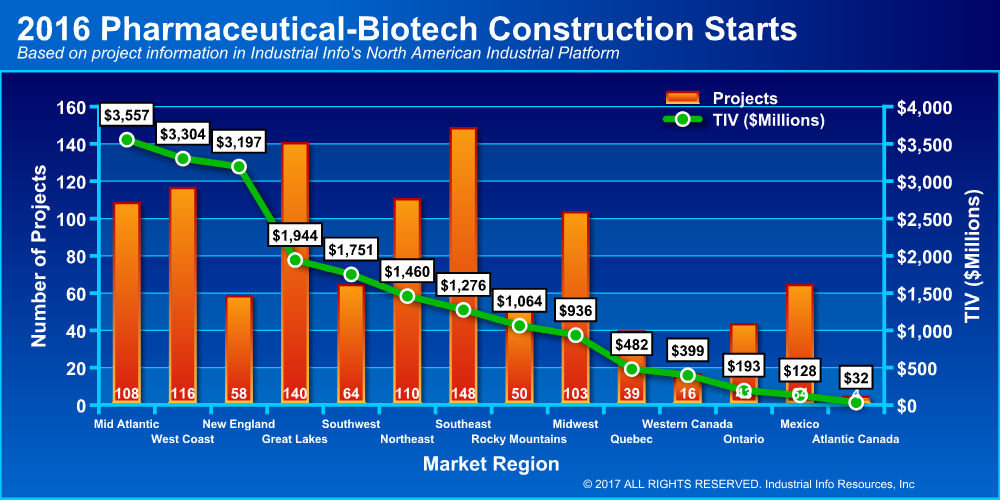

Reported by Annette Kreuger, Industrial Info Resources (Sugar Land, Texas)--With 2017 in its earliest days, let's take look back at some of the high points in 2016. A recent analysis of reported projects that began construction in 2016, derived from Industrial Info's Pharmaceutical-Biotech Online Platform, has revealed that the North American Pharmaceutical & Biotech Industry kicked off a healthy $19.7 billion worth of construction activity.

Click on the image at right for a breakdown by market region of 2016 Pharmaceutical-Biotech construction starts in 2016.

Click on the image at right for a breakdown by market region of 2016 Pharmaceutical-Biotech construction starts in 2016.

Despite redundancy resulting from the industry's ongoing merger and acquisition activity, as well as economic fluctuations across the globe, 1,063 projects representing an average total investment value (TIV) of $18.5 million managed to make it to construction status.

Helping boost the year's totals was the launch of Novo Nordisk AS' (NYSE:NVO) (Bagsvaerd, Denmark) much-ballyhooed $2 billion plant in Clayton, North Carolina. When complete, the site will produce the active pharmaceutical ingredient (API) for use in the production of insulin.

The mega projects make the headlines, and each is welcome news. But, just as valuable in their own right, are the hundreds of smaller projects that also make it to construction. Particularly the ones that did not make the headlines, all covering a wide spectrum of projects: capacity expansions, new production line additions, and smaller grassroot plants.

The 2016 projects represent a good reflection of the industry as a whole, and where its capital dollars are going: manufacturing and product development. All are sourced out to either the private or public sectors.

From a regional standpoint, the Mid-Atlantic leads for 2016. Encompassing North Carolina, South Carolina, Maryland, Virginia, West Virginia and Washington, D.C., the Mid-Atlantic kicked off $3.5 billion worth of projects in 2016. Even when removing the Novo Nordisk outlier that boosted it to the top spot, the region still housed a healthy $1.8 billion in 2016 project kickoffs, spread over 107 projects.

The West Coast, which includes California, Oregon and Washington, came in second, with an impressive $3.3 billion divided among 116 projects, returning a project average TIV of $28.4 million. In Rancho Cordova, California, AMPAC Fine Chemicals began a $30 million expansion of its API and Controlled API production facility with its existing capacity: APIs: 351 m3/92,780 gallons, Schedule II - V controlled substances: 9.65 m3/2550 gallons. When completed later this year, the project will have added nine new reactors, ranging from 500 to 2,000 gallons.

Rounding out the top three is the New England region: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont. The region delivered a solid $3.1 billion and 58 projects. Alnylam Pharmaceuticals Incorporated's (Cambridge, Massachusetts) $200 million construction of an RNA interference-based therapeutics plant in Norton, Massachusetts, brought welcome news to the region. The 200,000-square-foot building is going up in the Norton Commerce Center Industrial Park. It will produce therapeutics for the treatment of hepatitis D, dyslipidemia, hypertension, non-alcoholic steatohepatitis and type 2 diabetes.

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and 10 international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. Follow IIR on: Facebook - Twitter - LinkedIn. For more information on our coverage, send inquiries to info@industrialinfo.com or visit us online at http://www.industrialinfo.com.

Click on the image at right for a breakdown by market region of 2016 Pharmaceutical-Biotech construction starts in 2016.

Click on the image at right for a breakdown by market region of 2016 Pharmaceutical-Biotech construction starts in 2016.Despite redundancy resulting from the industry's ongoing merger and acquisition activity, as well as economic fluctuations across the globe, 1,063 projects representing an average total investment value (TIV) of $18.5 million managed to make it to construction status.

Helping boost the year's totals was the launch of Novo Nordisk AS' (NYSE:NVO) (Bagsvaerd, Denmark) much-ballyhooed $2 billion plant in Clayton, North Carolina. When complete, the site will produce the active pharmaceutical ingredient (API) for use in the production of insulin.

The mega projects make the headlines, and each is welcome news. But, just as valuable in their own right, are the hundreds of smaller projects that also make it to construction. Particularly the ones that did not make the headlines, all covering a wide spectrum of projects: capacity expansions, new production line additions, and smaller grassroot plants.

The 2016 projects represent a good reflection of the industry as a whole, and where its capital dollars are going: manufacturing and product development. All are sourced out to either the private or public sectors.

From a regional standpoint, the Mid-Atlantic leads for 2016. Encompassing North Carolina, South Carolina, Maryland, Virginia, West Virginia and Washington, D.C., the Mid-Atlantic kicked off $3.5 billion worth of projects in 2016. Even when removing the Novo Nordisk outlier that boosted it to the top spot, the region still housed a healthy $1.8 billion in 2016 project kickoffs, spread over 107 projects.

The West Coast, which includes California, Oregon and Washington, came in second, with an impressive $3.3 billion divided among 116 projects, returning a project average TIV of $28.4 million. In Rancho Cordova, California, AMPAC Fine Chemicals began a $30 million expansion of its API and Controlled API production facility with its existing capacity: APIs: 351 m3/92,780 gallons, Schedule II - V controlled substances: 9.65 m3/2550 gallons. When completed later this year, the project will have added nine new reactors, ranging from 500 to 2,000 gallons.

Rounding out the top three is the New England region: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island and Vermont. The region delivered a solid $3.1 billion and 58 projects. Alnylam Pharmaceuticals Incorporated's (Cambridge, Massachusetts) $200 million construction of an RNA interference-based therapeutics plant in Norton, Massachusetts, brought welcome news to the region. The 200,000-square-foot building is going up in the Norton Commerce Center Industrial Park. It will produce therapeutics for the treatment of hepatitis D, dyslipidemia, hypertension, non-alcoholic steatohepatitis and type 2 diabetes.

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and 10 international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. Follow IIR on: Facebook - Twitter - LinkedIn. For more information on our coverage, send inquiries to info@industrialinfo.com or visit us online at http://www.industrialinfo.com.