Power

Gas-Fired Power Development Taking Off in Mexico

Developers plan to build 50 gas-fired power plants in Mexico, valued at $27.4 billion, as part of the nation's effort to modernize its energy industries.

Released Monday, October 31, 2016

Reports related to this article:

Project(s): View 5 related projects in PECWeb

Plant(s): View 5 related plants in PECWeb

Written by John Egan for Industrial Info Resources (Sugar Land, Texas)--Developers plan to build 50 gas-fired power plants in Mexico, valued at $27.4 billion, as part of the nation's effort to modernize its energy industries. Many of those proposed projects, tracked by Industrial Info Resources' Industrial Project Platform, are not scheduled to begin construction until after 2018.

Industrial Info does not expect all of those projects will begin according to their proposed schedule. If history is any guide, some will be cancelled while others will be deferred. Still, the book of power generation business is significant.

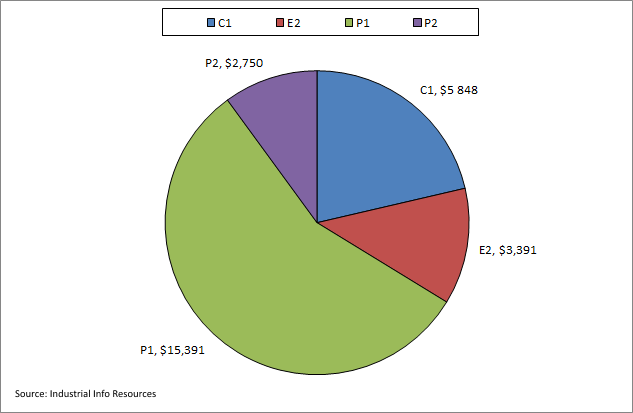

A dozen gas-fired power projects valued at about $5.8 billion are under construction, according to Industrial Info. Another eight projects valued at approximately $3.4 billion are in an advanced state of engineering. Thirty other projects worth more than $18 billion are in the planning stage.

Click the image at right to see a pie chart summarizing the stages of development for Mexican gas-fired power plants.

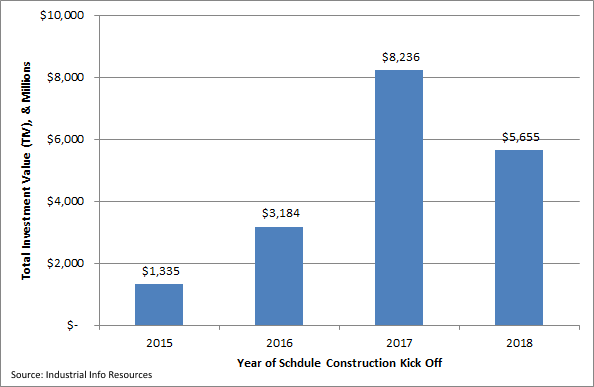

Click the image at right to see a pie chart summarizing the stages of development for Mexican gas-fired power plants.Roughly $1.3 billion worth of these power plants began construction last year, according to Industrial Info's Project Platform. Over $3 billion of projects are slated to begin construction this year. In 2017, more than $8 billion of projects are scheduled to begin turning dirt. Developers plan to begin construction on an additional $5.6 billion of projects in 2018.

Click on the image at right to see a chart with projects' scheduled kick-off dates by year.

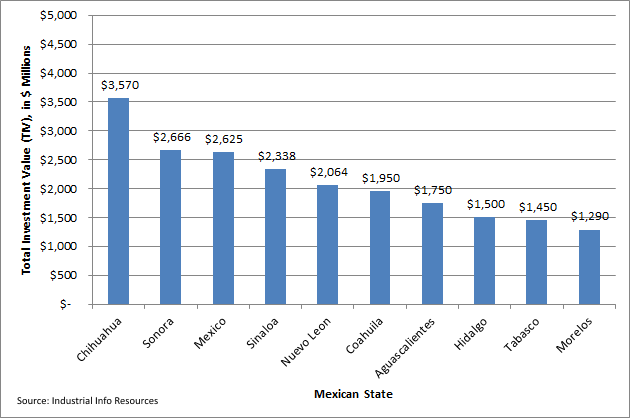

Click on the image at right to see a chart with projects' scheduled kick-off dates by year.Where are the projects scheduled to be built? The Mexican states where the largest dollar value of gas-fired power projects are scheduled to be built are Chihuahua, Sonora, Mexico and Sinaloa. At the other end of the spectrum, several states, including Tamaulipas, Queretaro, Guanajuato and San Luis Potosi, are scheduled to have only one gas-fired power plant built.

Click on the image at right to see a chart of which Mexican states are scheduled to have the highest dollar value of gas-fired power projects built.

Click on the image at right to see a chart of which Mexican states are scheduled to have the highest dollar value of gas-fired power projects built. Combined-cycle gas turbine plants won 72% of capacity contracts in Mexico's second round of electric power bidding, according to Mexican Energy Report, an industry newsletter published by ICIS (London, England). These contracts were won by various companies, including units of Sempra Energy (NYSE:SRE) (San Diego, California), The Blackstone Group L.P. (NYSE:BX) (New York, New York), Iberdrola (Bilbao, Spain) and Abengoa S.A. (Seville, Spain), as well as Comisión Federal de Electricidad (CFE), Mexico's electric grid operator and formerly the state-owned electric monopoly, the newsletter reported. Mexico announced the results of the bid September 28.

Mexico has been opening its electricity, oil and gas markets to allow private companies to do business there. In the power sector, the reforms are intended to introduce competition at the wholesale level by allowing private companies to bid to build electric generators, according to a mid-2016 report from the U.S. Energy Information Administration (EIA) (Washington, D.C.), the statistical and research branch of the U.S. Department of Energy (DOE) (Washington, D.C.).

The EIA report, "Mexico electricity market reforms attempt to reduce costs and develop new capacity," was released July 5. It noted one of the main drivers of the recent energy reforms is the large difference between the costs to produce electricity and the retail prices customers pay. "Mexico heavily subsidizes its retail electricity rates; by some estimates, the cost of supplying residential customers in Mexico is more than double the price that CFE charges them," the report said. "Officials hope that restructuring the power industry will reduce the costs of producing electricity, lowering or eliminating the government subsidies that maintain low retail rates."

While Mexico would seem to offer Power industry developers plenty of business opportunities, analysts also caution that doing business south of the border involves a very different set of risks than building power plants in the U.S. Also, the nation's first steps in liberalizing its energy markets were not without a few hiccups, though observers predicted those missteps would be fixed. For more information on doing business in the Mexican power market, see March 18, 2015, article - Mexican Electricity Liberalization: Promising Yet Perilous and August 4, 2015, article - Mexico's Energy Liberalization Has Rocky Start, but Expert Predicts Fast Recovery.

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and 10 international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. Follow IIR on: Facebook - Twitter - LinkedIn. For more information on our coverage, send inquiries to info@industrialinfo.com or visit us online at http://www.industrialinfo.com.

/news/article.jsp

false

Want More IIR News?

Make us a Preferred Source on Google to see more of us when you search.

Add Us On GoogleAsk Us

Have a question for our staff?

Submit a question and one of our experts will be happy to assist you.

Forecasts & Analytical Solutions

Where global project and asset data meets advanced analytics for smarter market sizing and forecasting.

Learn MoreRelated Articles

-

Gas-Fired Power Development Expected to Surge Across North A...February 13, 2017

-

Mexican Natural Gas Power Plants Warrant New Cross-Border Pi...August 03, 2016

-

Mexican Electricity Liberalization: Promising Yet PerilousMarch 18, 2015

-

Mexico's Comision Federal de Electricidad Re-Launches BOOM T...September 20, 2013

Industrial Project Opportunity Database and Project Leads

Get access to verified capital and maintenance project leads to power your growth.

Learn MoreIndustry Intel

-

From Data to Decisions: How IIR Energy Helps Navigate Market VolatilityOn-Demand Podcast / Nov. 18, 2025

-

Navigating the Hydrogen Horizon: Trends in Blue and Green EnergyOn-Demand Podcast / Nov. 3, 2025

-

ESG Trends & Challenges in Latin AmericaOn-Demand Podcast / Nov. 3, 2025

-

2025 European Transportation & Biofuels Spending OutlookOn-Demand Podcast / Oct. 27, 2025

-

2025 Global Oil & Gas Project Spending OutlookOn-Demand Podcast / Oct. 24, 2025