Power

Will Planned New York Project Ignite Offshore Wind Industry?

Last week, the company developing a 90-megawatt (MW) offshore wind project 30 miles off the coast of Long Island, New York, held its first public meeting about its proposed project.

Written by John Egan for Industrial Info Resources (Sugar Land, Texas)--Last week, the company developing a 90-megawatt (MW) offshore wind project 30 miles off the coast of Long Island, New York, held its first public meeting about its proposed project. Roughly 75 people attended the open house held by the developer, Deepwater Wind LLC (Providence, Rhode Island). Many of those in attendance were local fisherman worried about how the proposed project could affect their livelihoods, according to New York Newsday reporter Mark Harrington, who covered the event. Supportive representatives from environmental organizations also attended the March 9 open house, he added.

Deepwater Wind developed the nation's first offshore windfarm, a 15-MW project off the coast of Rhode Island. Construction of that project finished in late 2016.

The Long Island project, South Fork, took a step forward in late January when the Long Island Power Authority (LIPA) (Nassau, New York), signed a 20-year power-purchase agreement (PPA) worth $740 million. The power agency agreed to buy all of the power generated by the South Fork windfarm. That project, under development for over a decade, is expected to kick off construction in 2019, and be operating by yearend 2022.

Harrington, the Newsday reporter, quoted several fishermen who worried about the South Fork project's potential impact on their livelihoods. He quoted Montauk commercial fisherman Richard Jones as saying, "The cable runs right through the heart of where I fish." Al Shaffer said his lobster fishing wouldn't be impacted, but the proposed placement of the cable bringing the power to shore would mean the end for trawling in Napeague Bay. "This will close it down," he said.

The project still needs approvals from two New York governmental agencies as well as federal agencies, the Newsday article noted. As a candidate, President Trump criticized an offshore windfarm off the coast of Scotland as impairing the views from one of his golf courses. However, as a presidential candidate, Trump promised to streamline bureaucratic processes that have delayed energy projects. He also promised greater energy self-reliance.

If the South Fork project begins construction as planned, it might be eligible for some federal Production Tax Credits (PTCs). Those credits, extended at the end of 2015 for a five-year period, are prorated depending on when a project begins construction.

Europe has thousands of megawatts of offshore wind generation. But the history of offshore windfarm development in the U.S. is a story of tremendous potential blocked by local opposition. . Supporters, noting the trend to green the U.S. electricity supply, point out the high-quality wind resource that could power offshore windfarms. Opponents fear ruined vistas and the potential to damage commercial fishing.

It costs much more per megawatt of installed capacity to build a windfarm in the ocean compared to onshore, but costs are coming down. Government agencies are generally supportive, including offering tax credits, but developers must get through a long gauntlet of regulatory requirements before sinking steel into water.

Deep-pocketed homeowners, including the Kennedy and Koch families, were one of several factors that eventually stymied the Cape Wind offshore project, a 468-MW, $2.5 billion planned offshore windfarm that was scheduled to be built in Nantucket Sound, Massachusetts. That project, which won many regulatory and court challenges, failed to meet a project milestone at the end of 2015, and the utilities that had contracted to purchase its power terminated their PPAs. For more on that project, see January 15, 2015, article - Cape Wind Project's Future in Doubt after Utilities Cancel PPAs and October 26, 2012, article - Cape Wind Sets Sights on 2013 Construction Start. That project's developer, Energy Management Incorporated (EMI) (Boston, Massachusetts) spent more than a decade developing Cape Wind.

The nation's first offshore wind project, Block Island Offshore Windfarm, began operating in late 2016. That 30-MW, $300 million project was developed by the same firm developing the Long Island project, Deepwater Wind.

Beyond having a signed PPA, several other factors support the Long Island wind project. For one, New York Governor Andrew Cuomo is a strong supporter: He wants developers to build 2,400 MW of offshore wind generation by 2030. The state recently increased its renewable energy portfolio (RPS): by 2030, 50% of the state's electricity must be generated by renewable energy sources. The Long Island Power Authority, which contracted to buy all of South Fork's electricity, has a mandate of adding 280 MW of renewable electricity to the Long Island electric grid. And the town of East Hampton, Long Island, where South Fork's electricity will come ashore, has its own renewable energy goal: 100% renewable power by 2020. A windfarm 30 miles off the coast of Long Island will not be visible from the coast.

In January 2016, Cuomo unveiled the blueprint for building offshore wind generation in New York. A year later, in his 2017 State of the State address, the governor committed to having 2,400 MW of offshore wind generation by 2030. In that January 2017 address, Cuomo said, "New York's unparalleled commitment to offshore wind power will create new, high-paying jobs, reduce our carbon footprint, establish a new, reliable source of energy for millions of New Yorkers, and solidify New York's status as a national clean energy leader. The Offshore Wind Master Plan will establish a bold strategy to harness this untapped resource in New York and provide a new source of energy to power a brighter, greener future for all."

Two weeks after Cuomo's State of the State speech, when LIPA signed its PPA with Deepwater Wind, the company's chief executive, Jeffrey Grybowski, said: "This is a big day for clean energy in New York and our nation. Governor Cuomo has set a bold vision for a clean energy future, and this project is a significant step toward making that a reality. The South Fork Wind Farm will be the second offshore wind farm in America, and its largest. There is a huge clean energy resource blowing off of our coastline just over the horizon, and it is time to tap into this unlimited resource to power our communities."

Environmental groups cheered the signing of the PPA, but commercial fishing groups worried about the impact that building the 90-MW project could kill many fish.

Beyond the South Fork project, two massive offshore wind projects valued at $6.2 billion have been proposed off the New York and New Jersey coasts, including:

- Far Rockaway Grassroot Long Island-New York City Offshore Windfarm, a two-phase, 700-MW project valued at about $1.7 billion being developed by a unit of Consolidated Edison Incorporated (NYSE:ED) (New York, New York). This project, under development for nearly a decade, is still in the early planning stage. The first phase is scheduled to kick off construction in 2019 and be operating by yearend 2020.

- Cape May Garden State Offshore Windfarm, a three-phase, $4.5 billion project being developed by a unit of Public Service Enterprise Group Incorporated (NYSE:PEG) (PSEG) (Newark, New Jersey). Phase 1 of that project, years behind schedule, is expected to begin construction in 2020.

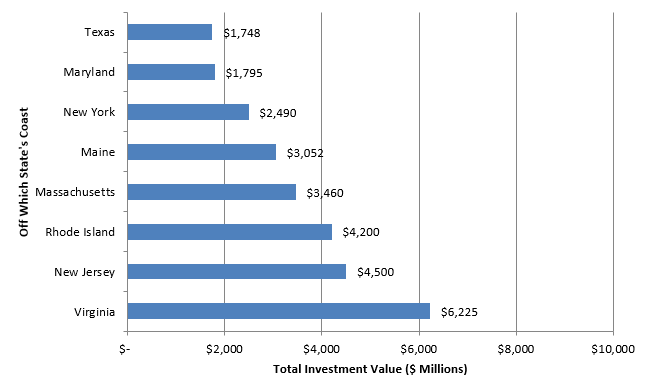

Click on the image at right to see the dollar value and location of planned U.S. offshore windfarms.

Click on the image at right to see the dollar value and location of planned U.S. offshore windfarms.Britt Burt, Industrial Info's vice president of research for the global Power Industry, made this comment: "Offshore wind projects are difficult to develop. There are a number of factors that suggest the South Fork project could move forward. But the industry will not soon forget what happened to the Cape Wind project. If South Fork is built 30 miles off the coast of Long Island, where it won't be visible to those on shore, that might fulfil the 'out of sight, out of mind' criteria."

Industrial Info Resources (IIR), with global headquarters in Sugar Land, Texas, five offices in North America and 10 international offices, is the leading provider of global market intelligence specializing in the industrial process, heavy manufacturing and energy markets. Industrial Info's quality-assurance philosophy, the Living Forward Reporting Principle, provides up-to-the-minute intelligence on what's happening now, while constantly keeping track of future opportunities. Follow IIR on: Facebook - Twitter - LinkedIn. For more information on our coverage, send inquiries to info@industrialinfo.com or visit us online at http://www.industrialinfo.com.

Want More IIR News?

Make us a Preferred Source on Google to see more of us when you search.

Add Us On GoogleAsk Us

Have a question for our staff?

Submit a question and one of our experts will be happy to assist you.

Forecasts & Analytical Solutions

Where global project and asset data meets advanced analytics for smarter market sizing and forecasting.

Learn MoreRelated Articles

-

Siemens, GE Vernova Increase U.S. Investment to Meet Gas Tur...February 04, 2026

-

Brookfield Upbeat on U.S. Odds for Renewable, Nuclear GrowthFebruary 04, 2026

-

Tunisia Plans 2.3 GW of Wind and Solar Tenders in 2026February 04, 2026

-

Winter Storm Gianna Slams Southeast With Intense Snow, Bitte...February 03, 2026

Industrial Project Opportunity Database and Project Leads

Get access to verified capital and maintenance project leads to power your growth.

Learn MoreIndustry Intel

-

From Data to Decisions: How IIR Energy Helps Navigate Market VolatilityOn-Demand Podcast / Nov. 18, 2025

-

Navigating the Hydrogen Horizon: Trends in Blue and Green EnergyOn-Demand Podcast / Nov. 3, 2025

-

ESG Trends & Challenges in Latin AmericaOn-Demand Podcast / Nov. 3, 2025

-

2025 European Transportation & Biofuels Spending OutlookOn-Demand Podcast / Oct. 27, 2025

-

2025 Global Oil & Gas Project Spending OutlookOn-Demand Podcast / Oct. 24, 2025